Ban Công nghệ Thông tin

Tran Phuong Dung - Deputy General Director

![]()

Ms. Tran Phuong Dung is currently Deputy General Director of AASC Auditing Firm Co., Ltd.

Ms. Dung has worked at AASC Auditing Firm since 2015. In October 2016, she was appointed Deputy Director of Branch of AASC Auditing Firm in Ho Chi Minh City and in April 2022, she was appointed Deputy General Director of AASC Auditing Firm Co, Ltd.

Ms. Dung graduated with a major in Waterworks Construction from the University of Transport of Ho Chi Minh City in 2003 and in 2015 she graduated with a major in Finance and Banking from the University of Economics in Ho Chi Minh City. She is a leading expert in the field of consulting audits on finalization of completed projects. She has directly participated in directing, operating and organizing the successful implementation of many audits of completed projects. Typical large-scale projects such as: Project to deal with tidal flooding in HCMC with consideration of climate change (Phase 1); New Construction Project of Children's Hospital in Ho Chi Minh City, New Construction Project of General Hospital in Thu Duc, Cu Chi, Hoc Mon areas in Ho Chi Minh City; Alin B1 Hydropower Plant Project; Eanam Wind Power Plant Project; Thuan Nam Ninh Thuan Solar Power Plant Project; Project of Floors and Car Parking at Vinh Airport; The project of raising the capacity of 500kv O Mon substation,... and hundreds of construction projects of corporations, corporations, units, state-owned enterprises, listed companies, public companies, and organizations and businesses operating in all sectors of the economy.

Continuing to update her expertise and gain experience in auditing consulting, Ms. Dung is also an expert in the fields of financial and accounting consulting, risk management consulting and asset valuation consulting helping clients perfect their accounting system, improve the quality of financial management and business administration, and bring practical benefits to many AASC's customers. Realizing AASC's development aspirations, she is with the Company's leaders, the Board of Directors of AASC Branch in Ho Chi Minh City, focusing on developing Valuation, Equitization, and Finalization Auditing services. Completed projects, Financial statement audit services, ...

In recognition of her contributions to the Finance and Independent Auditing industry in Vietnam, Ms. Tran Phuong Dung was awarded by the Minister of Finance: Certificate of Merit, the title of Emulation Fighter of the Finance Sector.

Transparency Report 2022

Transparency Report 30 September 2022 see here

Audit of Project Settlement Report

Implementing the policies of the Communist Party and the State on cost-effective practices and waste prevention in construction investment, since 1993, AASC has employed and trained our staff and auditors with good ethics, professional experience and expertise, including more than 60 architectures, construction engineers, transportation engineers, etc.

Annually, AASC has implemented and completed many audit contracts of project settlement report, comprising of many complex projects such as North-South 500KW power transmission line, Hoa Binh hydropower plant, Dau Tieng irrigation work, Tri An hydropower plant, Song Hinh hydropower plant, Lao Cai Apatite work, etc. We also carried out the audit of many critically important projects of the Communist Party, the National Assembly, the Government, Ministry of Defence, Ministry of Finance such as Meeting room of the Political Bureau, the Secretariat, the Executive Committee, Government Buildings at 37 Hung Vuong street and at 5 Le Duan street, National Conference Center, Power upgrade project at Ho Chi Minh Mausoleum, Memorial of heroic martyrs, Funeral Home of Ministry of Defence.

The audit of project settlement report carried out by AASC have helped investment owners to eliminate unreasonable expenses, save thousands of billion VND of the State budget and the investment owners. Especially, we have contributed to facilitating the timely settlement and approval of investment capital settlement, helping clients to strengthen their accounting and internal control system.

Project settlement report audited by AASC has been approved and highly appreciated by Office of the Party Central Committee, Government Office, Ministry of Finance, Ministry of Defence, Economic Groups, State-owned enterprise and other competent authorities.

Financial Statement Audit Services

Financial Statement Audit is one of the key factors creating AASC brand value and is one of our strength as well. This activity has achieved continuous improvement in both quantity and quality. Currently, in the field of financial statement audit, AASC has more than 250 experts with extensive experience in finance, accounting, auditing, credit and tax, etc. Annually, our auditors have conducted many financial statement audit engagement for companies and projects funded by international organizations. Most of our clients are state-owned enterprises, economic groups, giant corporations, foreign investment companies, commercial banks, government and public organizations and other companies across the nation.

With audit services, AASC has helped our clients to solve their problems and strengthen their accounting and internal control system in order to improve the quality of financial management and business administration.

Internal audit services

The above Decree has created a solid foundation for the consolidation and development of management and governance of economic organizations, units and enterprises that have great influence on the entire Vietnamese economy. . Clause 3, Article 10 and Clause 2, Article 24 of Decree 05/2019/ND-CP have allowed enterprises to be hired by independent auditors to perform internal audit services.

After more than 30 years of auditing, financial consulting, accounting, tax and valuation activities, in order to stand side by side with businesses that need support on internal audit activities, AASC has come up with synchronous solutions. on services related to modern internal audit activities, ensuring compliance with Vietnamese regulations and international practices.

Services related to AASC's internal audit activities include:

- Consulting services related to internal audit

- Internal audit implementation service

- Service of providing human resources for internal audit

Consulting services related to internal audit

- Consulting on building internal audit regulations and processes

- Consultancy on organization of modern internal audit apparatus

- In-depth training consultancy on internal audit

- Consulting to evaluate the quality of internal audit activities

- Other consulting services on internal audit at the request of customers.

Internal audit services:

Internal audit service is deployed by AASC through the following methods:

- Implement the internal audit package

- Co-implementing internal audit

AASC's internal audit services include:

- Performing audits to evaluate the performance of each topic and comprehensively.

- Carry out thematic and comprehensive compliance audit.

- Comprehensive internal audit.

- Other internal audit services at the request of customers.

Internal audit human resource supply service

- Provide highly qualified and experienced human resources to directly perform internal audit work under the management of the enterprise.

- Provide human resources with high professional qualifications and profound management experience to create and perfect the internal audit apparatus.

Other services on supplying high-quality human resources

Valuation services

AASC's appraiser team was granted the first keyword Valuation Valuation Card in 2005 and has been supplemented over the years, so far, it has always maintained over 30 Valuation Valuations.

This team, in addition to extensive expertise in valuation, is also an Auditor, Tax Consultant, and a construction investment technician with extensive experience, pure professional ethics and bravery in the field of construction. The fields of finance, accounting, tax, and project settlement have been completed through the practice of AASC and the Appraisal Industry.

AASC provides appraisal services including:

- Appraisal of enterprise value, especially large-scale enterprises that are economic groups, corporations..., spread out and diversify production, business and service activities.- Valuation of large-scale real estate projects.

- Valuation of construction investment projects

- Valuation of intangible assets, specific assets such as exploitation rights, brand value, value of benefits in business cooperation, etc.

- Valuation of assets being construction works, machinery and equipment, motor vehicles, etc.

Meeting a variety of valuation purposes of customers such as transfer of capital contribution in the enterprise, merger and consolidation of enterprises; as collateral in transactions with credit institutions; property purchase and sale; joint venture, …

Known and trusted AASC customers include:

- State-owned economic groups and corporations: Vietnam Oil and Gas Group, Vietnam Electricity, Vietnam Posts and Telecommunications Group, Vietnam Rubber Industry Group, and Chemical Group Vietnam, State Capital Investment Corporation, Vietnam Post Corporation, Vietnam Airport Corporation, PetroVietnam Chemicals and Services Corporation, Corporation 36 - Defense Department, Petrol Corporation, Coastal Corporation - Defense Department, Viglacera Corporation,....

- Non-state economic groups: Sungroup, Vingroup, BRG, Sovico, Sunshine, Hai Phat, Tan Hoang Minh, ...

- Domestic enterprises and foreign enterprises investing in Vietnam, ...

- Partners of commercial banks: Viettinbank, BIDV, Agibank, MB, Vietcombank, HDBank, ...

Tax Services

General description

Tax is one of the mots concerns of enterprises in business decision-making. Nowadays, with the orientation of self-responsibility in compliance with tax policies and laws promulgated by tax authorities and the Vietnamese government, enterprises pay too much attentions on tax compliance and make a plan to reach an optimal tax cost during their operation.

Our AASC service advantages

With 30 years of experience in providing services to thousands of clients operating in many different sectors of the economy in addition to our team of experienced and knowledgeable experts on prevailing regulations and laws, we can provide professional advices / solutions to harmonize tax issues in the broad business picture to support clients to achieve their above-mentioned goals.

Beside general experience, some specific fields such as real estate and cars are also our expertise thanks to many years providing services of VAT refund, import tax refund, tax planning and consulting for car manufacturing, and for lots of prestige clients such as Vinaconex, HUD, T&T group, Vinfast… We can also support clients in application procedures for tax exemption under double taxation agreements to significantly save the foreign contractor tax payable in Vietnam.

Our business advantage is enhanced by our ability to form interdisciplinary expert groups based on AASC resources and the HLB global network not only in taxation but also in accounting and consulting. We also maintain a regular and constructive dialogues with tax authorities, concurrently participate as a standing committee member in the Vietnam Tax Consulting Association (VTCA) to timely catch up with emerging tax issues and the most common concerns of the business community.

AASC’s tax services

1. Business tax service

In the context of increasing current regulations and laws on penalties for non-compliance of tax, the timely identification of impact and compliance from the beginning will help enterprises effectively manage tax risks at optimal cost.

Our business tax services include:

• Market penetration service: we support foreign enterprises planning to do business in Vietnam or domestic companies that want to expand their business. Our market penetration consulting team can assist with strategy, market penetration analysis, tax and legal structure or provide appraisal service for deals.

• Tax review service: check compliance with all types of VAT, PIT, CIT, contractor tax, special consumption tax...; risk alerts and plans to reduce future tax risks; assist businesses during the tax audit/inspection;

• Support service for tax inspection and dispute resolution: after tax review service, we will point out risks that tax inspectors may aim to, consult the documentation, add documents, concurrently prepare contention, support businesses in explaining directly to tax authorities during the inspection process, review the results after the tax audit, inspection period and tax dispute resolution services to the highest tax authority.

• VAT refund service: including preparation of documents and procedures, and assistance in answering questions, explaining to tax authorities during the VAT refund process. The implementation of VAT refund according to new investment projects and export production.

• Import and export tax refund services by sector, customs finalization reports preparation: We will support enterprises to prepare customs finalization reports, import and export tax refund, especially in specific areas such as import tax refund for the automobile manufacturing industry, supporting industries (including import tax refund under Decree 57/2020/ND-CP and Decree 125/2017/ND-CP), to consult on the application of trade agreement, on determination of domestic components that haven’t been produced yet, on customs value when refunding import and export tax...

• Contractor tax services and contractor tax refund under double taxation agreement: we will support enterprises to assess, calculate contractor tax for payments to foreign suppliers, review the possibility of contractor tax exemptions application and instruct clients on the procedures for applying for tax exemption and refund to save tax for clients.

• Tax planning and consulting services: consult tax impacts on making business decisions, enterprise purchase/sale, merger or restructuring decisions, strategic planning of business, transnational or domestic decisions.

• Fast and regular tax advisory service: provide rapid and regular advice about tax matters which enterprises are interested in, confirm their understanding or merely check uneasy problems. Quickly update information of tax law changes for businesses.

2. Personal income tax (PIT) service

AASC will provide PIT services for business and individuals, including:

• PIT declaration and PIT finalization service: cooperate with clients to collect relevant documents, evaluate taxable and non-taxable income and prepare provisional returns, PIT finalization returns.

We can also support clients with related services during this process, including immigration services such as assisting clients with required visas, work and residence permits, as well as identifying applicable visa categories, giving advice on immigration matters and processes; and assisting in reviewing and registering social insurance procedures, planning to optimize insurance cost.

• Payroll service: coordinate with clients to collect relevant documents, provide personnel for the salary calculation and ensure the salary calculation to comply with current regulations.

• Support service for tax review and tax audit, inspection: assess and review the compliance with PIT and SHUI before any tax audit and inspection. Provide advice on how to minimize potential risk issues and determine the level of risk in case of tax audit and inspection. Review, assess and provide professional support throughout and after the tax audit and inspection process, consult and respond to problems raised and work closely with clients to come up with the most suitable strategy.

3. Tax services for business mergers and acquisitions

In today’s market economy, mergers and acquisitions are a regular activity which usually happen. However, these transactions need to be carefully considered in terms of taxation, especially cross-border transactions in order to make a judicious decision on the target object and the negotiated price.

As a result of a member of the global HLB network, AASC can access/coordinate tax among network members, and join the "Mergers and Acquisitions Group of HLB", thus our clients have access to professionals who understand the way in which taxes affect transactions around the world. Our team of experts have a commercial mindset, they know how to identify and advise on actual tax risks in a transaction, and how to build deal structures in order to address tax impacts better.

Tax services group in business mergers and acquisitions include the following services:

- Review tax in particularly, tax assessment for purchase and sale of business

- Structure commercial affairs or arrange business in the direction of optimizing the tax impact

- Tax modeling

- Suppliers support

- Integration after commercial affairs

Contact us

For more information about our services or if you would like our experts to contact you, please do not hesitate to call us via the address:

Mr. Do Manh Cuong MBA CIMA FCCA FCPA Aust. FCPA Vietnam

Partner

This email address is being protected from spambots. You need JavaScript enabled to view it.

(84) 903 256 280

Transfer Pricing

Transfer pricing is considered the most important international tax issue facing business operations of companies operating across borders. However, the laws surrounding transfer pricing are becoming ever-more complex and today, and tax affairs of multinational companies are facing scrutiny from media and the public.

In Vietnam, Decree No. 20/2017/ND-CP dated 24 February 2017 has been issued to regulate and to provide guidelines on preparation of declaration forms and documents for determination of associated transaction prices. These regulations and guidelines are one of the most disputable arenas of tax, which require a substantial technique and information to comply with. Our transfer pricing experts will work with you, together with HLB International’s support, to develop a transfer pricing strategy suited to your multinational company.

How we can help

Our Transfer Pricing experts will help you create strategic advantage by using transfer pricing as a core management tool and deal with various issues of tax, so that you can focus on your business objectives.Our services typically include but are not limited to:

- Clarifying the transaction to be analysed and confirming that their structure and risk allocations serve your firm’s business objectives.

- Preparing functional profit and loss statements for all legal entities involved in the transaction being analysed.

- Analysing potential transfer pricing methods to determine which are best for your company’s circumstances.

- Conducting a thorough comparables search both internally and externally

- Reviewing pricing methodologies to select the best method and developing support for the chosen methodology.

- Devising appropriate documents to comply with tax authorities’ requirements

- Evaluating whether any additional work is needed to defend the transfer pricing methods used, and to develop a sound system of accounting documents.

Mr. Do Manh Cuong MBA CIMA FCCA CPA Aust. FCPA Vietnam

Deputy General Director

Audit and Assurance Services

Auditing and assurance services are one of our main service areas. With more than 2000 customers of all types of businesses in different industries, we have accumulated a lot of practical experience, always ready to serve all customers with the best quality of service. In addition to the traditional financial statement audit, most organisations experience needs for independent, objective assurance on financial information, transactions and processes. Independent assurance and verification adds credibility to an organisation’s disclosures and reporting, particularly when it is not a statutory requirement. We offers a range of audit related services.

- Completion Audits: Provides assurance around specific financial measures of an entity being bought or sold.

- Report on Internal Controls: Consists of reasonable or limited assurance engagements to provide an independent conclusion on internal controls conducted at a client’s request.

- Review Report: Expresses a moderate assurance conclusion on financial information where a full scope audit is not required.

- Agreed Upon Procedures: Performs procedures agreed between an entity and a third party to produce factual findings about financial information or operational processes.

- Compliance Audit: Provides assurance on an entity’s compliance with legal or contractual obligation e.g. loan covenants, donor’s funding conditions.

- Audit of Prospective Financial Information: Covers the potential consequences of possible future events and actions. It is future oriented and therefore speculative.

We seek to build and preserve the trust, respect and confidence of our clients by providing clear, relevant and timely advice.

Do Thi Ngoc Dung - Deputy General Director

Deputy General Director Do Thi Ngoc Dung is a leading consultant who is in charge of quality control of accounting, auditing, consulting and training services within and outside the Company. Ms. Dung graduated from the National Economics University, specializing in Accounting in 1998. During her 20 years of working at AASC, she has worked in various positions and has a lot of experience and has participated in the drafting of Law on Independent Audit, accounting standards and auditing at the request of the Ministry of Finance and the professional associations.

Mrs. Dung has extensive experience in the field of organization, administration and directly involved in auditing, financial accounting and tax consulting for many economic groups and corporations such as Vietnam Post and Telecommunication (VNPT), Vietnam National Chemical Group, Vietnam Rubber Group, Vietnam Cement Corporation, Vietnam Machinery Corporation (LILAMA), Vietnam National Coal and Mineral Industries Holding Corporation Limited – Vinacomin, Vietnam Water Supply Sewerage and Environment Construction Investment Corporation, JSCs listed on the stock market, large and complex joint stock companies operating in many areas of the national economy. As the head of many audits and consultants, Mrs Dung has brought many positive and effective comments to clients in developing and developing the financial management system.

In addition, Ms. Dung is a leading lecturer and has directly designed and taught many training courses for organizations and enterprises in Vietnam on corporate finance management and project financial management, internal control. With deep knowledge in financial management, accounting, auditing and tax, currently, she is a member of Vietnam Association of Certified Public Accountants (VACPA) and Vietnam Tax Consultants' Association (VTCA).

Ngo Minh Quy - Deputy General Director

Mr. Ngo Minh Quy is currently Deputy General Director of AASC Auditing Firm and a member of the Vietnam Association of Certified Public Accountants (VACPA), a member of the Vietnam Association of Tax Consultants (VTCA).

Mr. Quy has worked at AASC Auditing Firm since 2005. In 2016, he was appointed to the position of Director of AASC Branch in Ho Chi Minh City and in October 2019, he was appointed to the position of Deputy General Director of the firm. AASC Auditing.

With professional knowledge in financial accounting from Vietnam's leading university, professional associations and more than 17 years of working experience at AASC, Mr. Quy has directly participated in directing, operating and organizing the organization. The organization has successfully performed many large-scale financial statement audits for clients who are economic groups and corporations such as: Vietnam Rubber Group, Southern Food Corporation. , Coffee Corporation, Tin Nghia Corporation, Binh Duong Import-Export Corporation, Dong Nai Food Industry Corporation, ... and hundreds of units, state-owned enterprises, listed companies, public companies. public companies, securities companies and organizations and enterprises operating in all sectors of the national economy.

In addition to his expertise and experience in auditing financial statements, Mr. Quy is also an expert in the fields of financial accounting, tax consulting, risk management consulting and internal control to help clients perfect the system. accounting system and internal control system, improving the quality of financial management and business administration, bringing practical benefits to many customers of AASC. At the same time, he and the company leaders, leaders of AASC Branch in Ho Chi Minh City focus on developing valuation services, equitization, audit services and finalization of completed projects. .

In recognition of his contributions to the Finance and Independent Auditing industry in Vietnam, Mr. Ngo Minh Quy was awarded the Certificate of Merit by the Prime Minister in 2016, the Minister of Finance awarded the Certificate of Merit and the title of Emulation Fighter of the Industry. Finance.

Vu Xuan Bien - Deputy General Director

![]() Vu Xuan Bien is currently the Deputy General Director of AASC and is a member of Vietnam Association of Certified Public Accountants (VACPA), member of Vietnam Valuation Association (VVA), and member of Vietnam Tax Consultants' Association (VTCA).

Vu Xuan Bien is currently the Deputy General Director of AASC and is a member of Vietnam Association of Certified Public Accountants (VACPA), member of Vietnam Valuation Association (VVA), and member of Vietnam Tax Consultants' Association (VTCA).

Mr. Bien has been working for AASC since 2002. In 2007, he was appointed Head of Audit Department 2 - The unit was honored to be awarded the Third Labor Medal by the President and the Certificate of merit by the Prime Minister. In October 2016, he was appointed as Deputy General Director of AASC.

With expertise in financial accounting from the top universities in Vietnam and with more than 20 years of working experience at AASC, Mr. Bien has directly participated in successfully directing numerous audits and consultations. Large scale financial accounting for clients of big economic groups, state corporations such as Vietnam Post and Telecommunications Group, Vietnam National Coal and Mineral Group, Vietnam National Petroleum Corporation Nam, Vietnam Steel Corporation, Vietnam Cement Industry Corporation, Hanoi Housing Development and Investment Corporation, Vietnam Pharmaceutical Corporation, Bach Dang Shipbuilding Industry Corporation, Vietnam General Corporation Vietnam Oil and Gas Construction Joint Stock Company,... and hundreds of foreign invested companies, listed companies, public companies, companies securities, enterprises operating in all sectors of the national economy.

Mr. Bien is also a leading expert in AASC's financial advisory, risk management consulting, internal control systems, the valuation of assets and valuation of enterprises for equalizations.

Pham Xuan Thai - Deputy General Director

Mr. Pham Xuan Thai is currently Deputy General Director of AASC Auditing Firm and a member of the Vietnam Association of Certified Public Accountants (VACPA), a member of the Vietnam Association of Valuations (VVA), a member of the Association of Tax Consultants. Vietnam (VTCA).

Mr. Thai has worked at AASC Audit Firm since 1998. Since 2007, he was appointed as Head of Department and in October 2019, he was appointed as Deputy General Director of AASC Auditing Firm.

With professional knowledge in construction and finance and accounting from leading universities in Vietnam, professional associations, over 24 years of working experience at AASC, Mr. Thai has directly participated in directing, successfully managed and organized many consultations, audits and final settlements of key large-scale projects, such as: Ban Chat Hydropower Plant Project; Son La Hydropower Project; Lai Chau Hydropower Project; National Highway 1 Restoration Project Phase 3 (WB3); Transport Infrastructure Development Project in the Mekong Delta (WB5); Transport Development Project in the Northern Delta (WB6); Project of 3G, undersea fiber optic cable, CDMA network and core network of EVNT; The project of building bridges and roads connecting Noi Bai airport to Nhat Tan Bridge; Hanoi - Hai Phong Expressway Project; Construction project of Passenger Terminal T2 Noi Bai International Airport;... and hundreds of construction works of large corporations such as: Viettel, Vnpt, Vingroup, Sungroup, T & T, BRG, Bac A, TH, Vietnam Airlines Corporation,…

In addition to his expertise and experience in consulting on audit of completed project settlements and consulting on asset valuation, Mr. Thai and the Board of Directors of the Company also contributed ideas to the Ministry of Finance in the following years: drafting, amending and supplementing the Circular providing for the settlement of completed projects funded by the State; Circular on settlement of completed projects using public investment capital; Vietnam Auditing Standard No. 1000 – Auditing of financial statements of completed projects funded by the State; Contribute ideas for the Vietnam Association of Certified Public Accountants to update training documents on the Sample Audit Dossier applicable to the audit of the completed project settlement report, through which the AASC Auditing Firm has contributed contribute to the development of the Finance Industry and the Independent Auditing Industry of Vietnam.

Recognizing his contributions to Vietnam's Finance and Independent Auditing industry, Mr. Pham Xuan Thai was awarded the Certificate of Merit by the Prime Minister in 2010, the Minister of Finance awarded the Certificate of Merit, the title of Industry Emulation Soldier. Finance

Pham Anh Tuan - Deputy General Director

![]()

Pham Anh Tuan is currently the Deputy General Director of AASC and member of Vietnam Association of Certified Public Accountants (VACPA) and Vietnam Tax Consultants' Association (VTCA). He completed his Masters in International Accounting at Swinburne University of Technology, Australia.

Mr. Tuan has been working for AASC since 2001. With expertise in financial accounting from leading universities in Vietnam and prestigious universities in Australia, with about 22 years of experience working at AASC, Mr. Tuan has personally been involved in successfully directing large-scale audits in the fields of banking and finance, pharmaceuticals, industrial production, insurance, mining and communications, construction... and customers are economic groups, state corporations, enterprises operating in all sectors of the national economy.

In addition to expertise and experience in auditing financial statements, Mr. Tuan is also a leading expert in AASC in the field of accounting services, tax consultancy, tax consultancy and consulting services, risk management and internal control systems, business restructuring and business management consulting.

Especially, as been the head of Information Technology Department of AASC and experienced in the field of finance and accounting, Tuan has gained the trust of customers in consulting IT solutions. Microsoft and business intelligence solutions based on cloud computing technology of leading companies such as Zoho, Bitrix24 ... include:

- Consulting copyright software solutions for Windows software, Office 365 and Microsoft's Microsoft Azure cloud;

- Consulting 35 business management solutions based on Bitrix24 has gained the trust of more than 1 million customers;

- Consulting 30 comprehensive enterprise management solutions based on Zoho platform to meet the needs of customers;

- Consulting solutions on customer relationship management (CRM), email system and online conferencing...

- Consulting ERP implementation and ERP acceptance.

.

Do Manh Cuong - Deputy General Director

Mr. Do Manh Cuong is the Standing Deputy General Director of AASC Auditing Firm and Chief Executive Officer of AASC Consulting and Associates Company Limited (ACG) – a consulting branch of AASC Auditing Firm, specializing in providing professional services of Financial, Accounting, Tax Consultancy and Risk management.

Mr. Do Manh Cuong started working at AASC Auditing Firm in 2003 after many years of working in financial management in foreign direct investment (FDI) enterprises. In 2007, he was assigned as a manager of Foreign Investment Services Department – specializing in providing Auditing and Financial Accounting Consultancy Services to FDI enterprises, General Corporations, Business Groups, projects funded by international credit organisations (such as World Bank, Asia Development Bank, etc) and Non-governmental organizations. In 2010, he was assigned as a Deputy General Director of AASC Auditing Firm and became the youngest Deputy General Director in the history of the Firm.

For more than 20 years working at AASC along with nearly 19 years holding many leadership positions, Mr. Do Manh Cuong has directed successfully major audit courses of ODA projects (including projects conducted outside Vietnam’s territory), General Corporations operating in many provinces and FDI enterprises operating in various economic sectors. Besides extensive professional knowledge and experience in financial statement audit, he is also a top expert of AASC in consulting on preparation of financial statement in accordance with international accounting standards (IFRSs/IASs), advisory on risk management, internal control system, business restructuring and management.

He has collaborated with many international consultants in a number of critical projects such as project of Strengthening the Capacity of the State Audit in Vietnam, project of Improving Financial Management Ability of Vietnam Railways Corporation, etc. In addition, he also co-operated with other experts of World Bank in the project of Reviewing Financial Situations of several priority projects using capital borrowing from World Bank, etc.

Currently, Mr. Do Manh Cuong is a fellow member of Association of Chartered Certified Accountants (ACCA), Vietnam Association of Certified Public Accountants (VACPA), Chartered Institute of Management Accountants (CIMA), and the Certified Internal Auditor of the Institute of Internal Auditors (IIA). He is also a fellow member of CPA Australia (CPAA) and the member of CPAA Hanoi Advisory Committee. He also successfully completed the Executive Master of Business Administration (EMBA) at the University of Hawai'i at Manoa (USA).

To appreciate Mr. Do Manh Cuong 's contributions to the field of Vietnam's Finance and Independent Auditing, the President awarded him the Third Class Labor Medal in 2018 and the Prime Minister awarded him the Certificate of Merit in 2011. Then Mr. Do Manh Cuong was also awarded the Certificate of Merit and the title of Emulation Soldier in the field of Finance by the Minister of Finance.

Advisory Services

-

Investment Advisory Services (IAS)

- Consulting and support of investment promotion in Vietnam

- Market research (or as clients’ orders) -

Project Management Services (PMS)

-

- Appraisal and evaluation of capacity to implement and manage projects funded by foreign donors

- Project management and/or project's operation consulting

- Monitoring and/or Evaluation of project’s objectives (M&E)

- Planning, study and preparation of project's feasibility report

- Establishment of a set of ratios to evaluate projects’ operating results

- Design of project management procedure

- Training and organization of conferences on project - related issues -

Financial/Accounting Services (FAS)

- Review and consulting on financial / accounting issues

- Development of accounting and finance procedures and manuals

- Consulting on financial model, re-structuring and management (i.e.: cash flows, budget, etc.)

- Consulting on merger and acquisition and financial model restructuring -

Risk management services (RMS)

- Review and consulting on business risk management models

- Review of internal control system and consulting on improving internal control system

- Business and investment risk valuation and consulting

- Other risk management services -

Business Consulting Services (BCS)

- Review and positioning of a company in their operating markets

- Consulting on business and management models

- Identification of competitive advantages; development of value chain and consulting on establishing long-term strategies -

Training services (TNS)///

Valuation and Equitization Consulting Services

Implementing the policy of the Communist Party and the State on privatization of the State-owned enterprises into the Joint Stock Companies, since 2003, AASC has made a great development in the provision of business valuation and equitization consulting services. AASC has provided these services for numerous corporations under the Ministry of Industry and Trade, the Ministry of Construction, the Ministry of Planning and Investment, the Ministry of Agriculture and Rural Development, the Ministry of Transport, and Hanoi People’s Committee, People’s Committee of Ho Chi Minh City, Hai Duong, Quang Ninh, Lang Son, Tien Giang, Ca Mau provinces, subsidiaries of Vietnam Southern Food Corporation, Vietnam Construction and Import - Export Corporation – VINACONEX, Vietnam Electricity Group, Vietnam National Shipping Lines, Vietnam Airlines Corporation, Vietnam Machinery Installation Corporation - Lilama, Vietnam Cement Corporation, Viglacera Corporation, etc. AASC's services has always been trusted by clients nationwide. After the completion of business valuation services, most companies have requested AASC for further consulting services to fasten the equitization progress, consulting services on business valuation in phase 2 for the hand over between State-owned enterprise and joint stock Company and Financial Statement Audit for joint stock companies after equitization process. In the coming years, for further integration and development, AASC will continuously improve quality services, provide the best business valuation services and consult the most optimal solutions for clients to achieve their equitization objectives.

Asset Valuation

Business Valuation

Accounting and Finance Appraisal.

Accounting Services

AASC was established in 1991 as a company in provision of accounting services. Our business advantage is enhanced by our ability to form interdisciplinary expert groups based on AASC resources and the HLB global network not only in accounting, tax consulting but also in the corporate management consulting. We also maintain a regular and constructive dialogues with tax authorities, concurrently participate as a standing committee member in the Vietnam Tax Consulting Association (VTCA) to timely catch up with emerging tax issues and the most common concerns of the business community.

AASC’s accounting services have been highly acknowledged and trusted by the Ministry of Finance and numerous clients. This is also one of the fields that AASC has advantages in personnel and experience. AASC provides various accounting services to our clients, including:

- Setting up accounting system and organizing accounting work for newly established companies; developing internal economic information system for business administration.

- Reviewing, analyzing, innovating, and rationalizing existing accounting and financial system.

- Consulting clients about accounting work such as preparing and rotating documents; bookkeeping; identifying cost pools and calculating unit price; reviewing, adjusting accounting data and closing accounting books; preparing financial statements, project settlement reports, etc.

- Especially, AASC along with officers of General Department of Taxation and Departments of Tax in Hanoi, Ho Chi Minh City, Hai Phong, Nam Dinh, Hung Yen… help and instruct thousands of private companies & household businesses to open and record accounting books in accordance with the legal regulations. With these activities, AASC has supported Tax authorities and Financial authorities in surveying the operation of business households, which forms the basis for adjusting tax rate and studying tax policies of this economic sector.

Our commitment to service quality is expressed in the following aspects:

• UNDERSTANDING CUSTOMER NEEDS: Understanding needs based on customer desires and business goals of each business is the basis for us to be able to offer optimal solutions.

• SUITABILITY CONSULTANTCY FOR CUSTOMERS: Depending on the customer's financial and human resources, we will advise on implementing appropriate features to ensure customers use the service effectively and master technology.

• RISK MANAGEMENT AND WARNING TIMELY: Update policies promptly & use AASC's team of experienced experts to analyze and evaluate actual customer situations to advise on risk issues during providing services.

• ACCOMPANY WITH CUSTOMERS: Using AASC's services is not a destination, it's a journey. We always accompany customers throughout the using our services to advise, support, update & provide practical training to customers.

HLB International network

HLB International is the world-wide network with fast growth and sustainable development. Established in 1969, HLB International’s annual revenue is ranked “Top 12” among network companies operating mainly in auditing, accounting and international professional management.

HLB International (HLBI) is a member of the Forum of Firms with annual revenue of over USD 2 billion. HLB always focuses on the development of quality service and human development, strictly controls the quality of service of its members, supports the update and sets stringent requirements for member firm’s service quality.

Since February 2011, AASC is officially a member of HLB International – a worldwide network of independent auditing firms and business advisers. Together with other members of HLB International comprising of 27,485 staff across 153 countries around the world, AASC is committed to providing excellent professional services by international standards for our clients, towards the methodology of “Together we make it happen’’..

Ngo Duc Doan – Chairman of Board of Members

Being an expert of the Department of Accounting and Auditing Regulations, Mr. Ngo Duc Doan was assigned to establish and develop the Auditing and Accounting Financial Consultancy Service Company (AASC) from May, 1991. “From the very beginning, AASC is going in line with his professional career”. With firm professional knowledge, deep understanding, extensive experience, strategic vision and wholehearted dedication to AASC, Chairman of Broad of Members, General Director Ngo Duc Doan has significantly and effectively contributed to the development of AASC, the leading one among Vietnamese Auditing Firms.

Being an expert of the Department of Accounting and Auditing Regulations, Mr. Ngo Duc Doan was assigned to establish and develop the Auditing and Accounting Financial Consultancy Service Company (AASC) from May, 1991. “From the very beginning, AASC is going in line with his professional career”. With firm professional knowledge, deep understanding, extensive experience, strategic vision and wholehearted dedication to AASC, Chairman of Broad of Members, General Director Ngo Duc Doan has significantly and effectively contributed to the development of AASC, the leading one among Vietnamese Auditing Firms.

Mr. Ngo Duc Doan has over 31 years of experience in leadership, management and administration in AASC. In addition, he has conducted many researches in financial and accounting policies and regimes, provided economic management consultancy and professional services to many Ministries, Sectors, Business Groups, General Corporations, Foreign Direct Investment enterprises, Listed Companies, Foreign funded projects such as: Vietnam Electricity Group, Vietnam National Petroleum Group, Vietnam National Coal - Mineral Industries Holding Corporation Limited, Vietnam Posts and Telecommunications Group (VNPT), Vietnam Military Telecom Corporation (Viettel), Strengthen the Capacity of State Audit in Vietnam project funded by the European Commission, etc.

He also participated in training courses on Auditing, Accounting and Financial Consultancy of the EURO TAP VIET project in United Kingdom, France, Belgium, and Netherlands. In 2003, he graduated Master of Business Administrative program of AMOS Tuck School of Business Administration – U.S. He carried out researches and surveys to gain experience in financial management of companies in UK, U.S., Japan, China and Korea. Currently, Chairman of the Board of Member, General Director Ngo Duc Doan is a member of Central Executive Board of Vietnam Association of Accountants and Auditors (VAA) and a member of Executive Board of Vietnam Associations of Certified Public Accountants (VACPA).

Mr. Doan honored to receive the prestigious awards of the Communist Party, the State and other professional associations such as: Second-class Labour Medal, Third-class Labor Medal, 02 merits of the Prime Minister, Medal “For the cause of Science and Technology Associations” of the Vietnam Union of Science and Technology Associations”.

Cat Thi Ha - Deputy General Director

Mrs. Cat Thi Ha graduated from National Economic University, majoring in Auditing. During over 23 years of working at AASC Auditing Firm, she has been assigned to work at different positions. Currently, she is an auditor, an appraiser and a consultant in finance, accounting and tax of AASC. She has gained extensive experience in various fields such as:

Mrs. Cat Thi Ha graduated from National Economic University, majoring in Auditing. During over 23 years of working at AASC Auditing Firm, she has been assigned to work at different positions. Currently, she is an auditor, an appraiser and a consultant in finance, accounting and tax of AASC. She has gained extensive experience in various fields such as:

+ Organize, lead and actively participate in providing audit courses, financial, accounting and tax consultancy services to number of groups and general corporations such as Vietnam Rubber Group, Vietnam National Chemical Group, Vietnam National Coal and Mineral Industries Holding Corporation Limited – Vinacomin, Micco Mining Chemical Industry Holding Corporation Limited, etc; listed companies and major joint stock companies operating in diversified economic sectors such as Bao Minh Insurance Corporation, Vietnam Southern Food Corporation, etc.

+ Organize, lead and involve actively in providing business valuation for equitization of State-own enterprise under Ministries, Sectors, Hanoi People’s Committee, Ho Chi Minh City People’s Committee and other provincial People’s Committee nationwide.

+ Organize, lead and involve actively in providing equity appraisal services for Vietnam Post and Telecommunication (VNPT), Vietnam National Chemical Group, Northern Electricity Corporation, Vietnam Construction and Import-Export Joint Stock Corporation – Vinaconex, Vietnam Airlines Corporation, Hanoi Housing Development and Investment Corporation, etc and their subsidiaries and associates.

+ Organize, lead and involve actively in providing equity and assets valuation services for Vietnam Electricity Group and their subsidiaries, number of units under Vietnam National Chemical Group and Vietnam Post and Telecommunication Group (VNPT) at 0am on 01/07/2011 according to the requirement of the Prime Minister.

+ Organize, lead and involve actively in appraisal course and providing information in price of real estate, machines, equipment and goods, etc for different purposes of our clients such as purchasing, transferring, sales, lending, etc.

With professional knowledge, extensive experience and wholehearted support to clients, Deputy General Director Cat Thi Ha has assisted and provided consulting advices to clients and received greatly appreciation from them. In 2008, she was honored to receive a Merit of the Prime Minister for her working effort in the field of audit, appraisal and finance, accounting and tax. She is a member of Vietnam Association of Certified Public Accountants (VACPA), Vietnam Valuation Association, etc.

Nguyen Thanh Tung - General Director

Mr. Nguyen Thanh Tung is a Master of Economics, General Director of AASC Auditing Firm. He is known as Vietnam's leading expert in the field of auditing, accounting and financial consulting and valuation.

Mr. Tung has been trained as an accountant and audit specialist by the EURO-TAPVIET project since 1998. He was granted the Auditor's Certificate by the Ministry of Finance in 1999, and in 2015 as a price appraiser. He has many years of working experience with the following titles: Lecturer at High School of Finance and Accounting 1 - Ministry of Finance - Officer of Hai Hung Department of Finance and Prices - Deputy Head of Department of State Capital and Asset Management at Enterprises - And is currently the General Director of AASC Auditing Firm Co., Ltd.

With nearly 31 years of experience in the audit industry, as an Auditor, Valuer and Company Leader, Mr. Tung has participated in directing many large audits for Economic Groups, corporations, state-owned enterprises, foreign-invested enterprises, projects sponsored by international credit institutions, etc.

Besides Auditing, Financial Consulting, Taxation and Valuation, Mr. Tung also has a deep understanding in researching, evaluating and appraising financial, accounting and auditing policies applicable to different businesses, groups, corporations, and at the same time advise businesses on effective solutions, which are trusted and highly appreciated by customers.

At the same time, Mr. Tung has always actively contributed to the development of professional associations in Vietnam. He is currently a Senior Member, Member of the Executive Committee of the Vietnam Association of Certified Public Accountants (VACPA) and a member of the Vietnam Valuation Association (VVA).

He has been honored with privileged awards of the State and the Government such as: Third-class Labor Medal, “National Emulation Solider” Title and merits of the Prime Minister, etc.

The brand AASC

The new logo of AASC has been created and developed in many years by experts in the field of branding and marketing, expressing the ideas of generations of leaders, auditors and staffs of AASC. The new logo has been designed based on both core values and traditional values which have built up AASC’s brand name in the last 27 years including: Transparency - Independence - Knowledge - Trust - Sustainability.

The new logo of AASC has been created and developed in many years by experts in the field of branding and marketing, expressing the ideas of generations of leaders, auditors and staffs of AASC. The new logo has been designed based on both core values and traditional values which have built up AASC’s brand name in the last 27 years including: Transparency - Independence - Knowledge - Trust - Sustainability.

The most important key factor, of which, is TRANSPARENCY with implication of providing transparent information to investors, the community, administrative agencies and other parties.

• 5 key factors of AASC’s new logo are illustrated by 5 sunbeams radiating from the center with the phrase “AASC”. The yellow-orange sunbeam expressed the aspiration for innovation. This is also the image of the sun with eternal energy to create an impulse to “push” AASC towards. In this image, the sun also indicates “TRANSPARENCY” - the most crucially core value of AASC.

• The image of 5 sunbeams radiating from the center also means: the convergence of the quintessence forming the image of a shining diamond which indicates “Being clear-minded” and sustainable relations within AASC.

• 5 sunbeams have been regarded as 5 key factors in geomancy: Metal, Wood, Water, Fire, Earth, illustrating the development of values of AASC, AASC’s clients and business partners.

• The phrase “AASC” is designed simply, in a modern way with international style (meaning of integration) indicating core values of AASC.

• The brown color of the phrase “AASC” is darker than the color of the main image indicating the rhythm of EARTH, the color of TRUST and INTELLIGENCE.

• Highlight phrase “Since 1991”

• Emphasized on the long-term history of AASC, the first audit firm established in Vietnam and known as “the leading Vietnamese independent audit firms”. The red color of the phrase indicates the inheritance from previous logos of AASC.

Overall, the new logo of AASC has crystallized from core values and traditional values of AASC as well as culture, practical experiences and achievements for near 30 years since 1991, forming an eternal energy to the successful development of AASC.

Contact Us

Please click on the service you need to get advice from us:

|

Audit and assurance services Nguyen Thanh Tung Bui Van Thao Deputy General Director Pham Anh Tuan Vu Xuan Bien Cat Thi Ha Pham Xuan Thai Vu Quy Cuong Accounting services Do Manh Cuong Pham Anh Tuan Nguyen Thanh Tung Pham Xuan Thai Nguyen Thanh Tung Do Manh Cuong Pham Anh Tuan Vu Xuan Bien Do Manh Cuong Advisory Services Do Manh Cuong Nguyen Thanh Tung Do Manh Cuong Pham Anh Tuan Vu Xuan Bien |

Valuation and Equitization Consulting Services Cat Thi Ha Cat Thi Ha Cat Thi Ha Training services Nguyen Thanh Tung Do Manh Cuong Nguyen Thanh Tung Do Manh Cuong Pham Xuan Thai Vu Quy Cuong Information Technology Audit and Digital Transformation Services Pham Anh Tuan |

Our leadership

|

Ngo Duc Doan

Chairman of Board of Members

|

||

|

Nguyen Thanh Tung

General Director

|

Bui Van Thao

Deputy General Director

|

Do Manh Cuong

Deputy General Director

|

|

Cat Thi Ha

Deputy General Director

|

Pham Anh Tuan

Deputy General Director

|

Vu Xuan Bien

Deputy General Director

|

Deputy General Director

|

Pham Xuan Thái Deputy General Director

|

Ngo Minh Quy Deputy General Director

|

Deputy General Director

|

Deputy General Director

|

Bui Van Thao - Deputy General Director

Graduated from Hanoi Academy of Finance and Accounting in 1983, with deep understanding of over 30 years working in Finance and Accounting, Deputy General Director Bui Van Thao has been in charge of AASC branch in Ho Chi Minh City. He has coordinated, directed and provided the best quality services to all of our clients operating in diversified economic sectors. He has also organized and conducted financial consultancy and document preparation services for business transformation from State Owned Enterprises to Limited Liability Companies such as: Vietnam National Chemical Group, Vietnam National Coal – Mineral Industries Holding Corporation, Vietnam Southern Foods Corporation, Vietnam Rubber Group, Vietnam Post and Telecommunication Groups (VNPT), etc.

Graduated from Hanoi Academy of Finance and Accounting in 1983, with deep understanding of over 30 years working in Finance and Accounting, Deputy General Director Bui Van Thao has been in charge of AASC branch in Ho Chi Minh City. He has coordinated, directed and provided the best quality services to all of our clients operating in diversified economic sectors. He has also organized and conducted financial consultancy and document preparation services for business transformation from State Owned Enterprises to Limited Liability Companies such as: Vietnam National Chemical Group, Vietnam National Coal – Mineral Industries Holding Corporation, Vietnam Southern Foods Corporation, Vietnam Rubber Group, Vietnam Post and Telecommunication Groups (VNPT), etc.

Additionally, with deep understanding in management and operations of various business types, he has given effective directions and advisory to better accounting and internal control system of many clients. Moreover, he has contributed significantly to improve the efficiency of financial management and business control and bring benefits to many enterprises. Currently, Deputy General Director Bui Van Thao is a member of Management Board of Vietnam Tax Consultants' Association (VTCA) and also a member of Vietnam Association of Certified Public Accountants (VACPA).

Professional experts

In order for the Company to develop sustainably, AASC people have always been trained in professional ethics, trained in professional qualifications, accumulated rich practical experience and fostered to improve the Company's culture. Currently, AASC has more than 500 staff, auditors, price appraisers, technicians, audit assistants and collaborators with university and postgraduate training majoring in finance, banking, and accounting. accounting and auditing at home and abroad, including about 80 Vietnamese auditors, 08 ACCA members, 03 Australian CPA members, 02 CIMA members, 01 CIA member, 01 CMA member, 31 Valuation appraisers, 35 Certificate of Tax Procedure Consulting. AASC has a lot of collaborators who are leading experts in many fields of specialized and professional activities that will surely fulfill and fulfill the legitimate requirements of customers.

In order to maintain the best service quality, increase competitiveness in the development of the Auditing and Valuation Industry, the Company always focuses on training and developing AASC people, and at the same time cooperates effectively with other companies. Independent audit firm, cooperates with the State Audit and specialized organizations in finance, securities, prices and professional associations in the country and internationally.

On the occasion of the 20th anniversary of the establishment of AASC and also the 20th anniversary of the establishment of the Vietnam Independent Auditing Industry (May 13, 1991 – May 13, 2011) National Assembly Chairman Vuong Dinh Hue, then the State Auditor General noted, “I am impressed and highly appreciate AASC's auditors training and retraining, which not only develops in quantity but also focuses on quality…”

About AASC

AASC Auditing Firm Co., Ltd. (AASC Auditing Firm Company Limited) has matured and continuously developed from the Auditing and Accounting Financial Consultancy Service Company of the Ministry of Finance, and is also a Member of HLB International in Vietnam (Global Network of Accountants and Consultants). AASC Auditing Firm is one of the first and largest legal organizations in Vietnam specializing in Auditing, Financial Consulting, Accounting, Taxation, Valuation and other legal services. Currently, AASC has its head office located in Hanoi, branch in Ho Chi Minh City and branch in Quang Ninh.

According to the Chairman of the National Assembly of Vietnam, Mr. Vuong Dinh Hue: AASC is currently a large service provider, who is the "Leader of the System of Vietnamese Auditing Firms", with diverse clients and highest ranking services of settlement report audit, enterprise valuation in the Vietnam Independent Auditing Industry...

Along with the Big 4 auditing firms operating in Vietnam, AASC is one of the 5 dynamic auditing firms with the largest annual revenue, customers, number of auditors and employees today (92 Vietnamese auditors, 08 ACCA members, 03 Australian CPA members, 02 CIMA members, 01 CIA member, 01 CMA member, 33 Price appraisers, 35 Tax Procedures Consultant certificates and almost 500 employees). During more than 33 years of operation, whether in the form of SOEs or limited companies, AASC's operating principles have always been steadfast in innovation, creativity and development, worthy the title of the first Accounting and Auditing Company of Vietnam to provide the highest quality services for the legitimate benefit of our clients. Our customers operating in all economic sectors: Economic Groups, State Corporations, Foreign Invested Companies, Listed Companies, Joint Stock Companies, Commercial Banks, projects using ODA capital, aid capital from the World Bank (WB), Asian Development Bank (ADB) as well as other international credit institutions and investment projects.

AASC becomes a FreshWorks solution partner in Vietnam

As part of the strategy of providing a digital transformation ecosystem in corporate governance, ADIGITRANS - AASC Digital Transformation has partnered with FreshWorks to provide world-leading technology solutions to customers for businesses in Vietnam and Southeast Asia, ADIGITRANS officially became a solution partner of FreshWorks in Vietnam. This cooperation not only opens up opportunities for both ADIGITRANS and FreshWorks in expanding the market, but also helps businesses have more choices and opportunities to access the world's leading information technology products and services. . FreshWorks' suite of cloud-based solutions provides ideal collaboration, helping businesses connect and communicate better with customers and across departments. FreshWorks not only provides businesses with a 360-degree overview of their customers, but it is also a set of tools that are easy to use and provide a quick return on investment.

General information about FreshWorks

FreshWorks was founded in October 2010 by Girish Mathrubootham and Shan Krishnasamy. With over 10 years of operation, currently, FreshWorks has its headquarters in California, USA and global offices in India, UK, Australia and Europe.

FreshWorks is backed by investments by Accel, Tiger Global Management, CapitalG (Google Capital) and Sequoia Capital India with a value of $3.5 billion. FreshWorks is used by more than 150,000 major brands around the world such as Honda, Bridgestone, Hugo Boss, University of Pennsylvania, Toshiba or Cisco. FreshWorks solutions have appeared in Gartner's market-oriented research rankings (Magic Quadrants) in 3 categories, including CRM Customer Engagement Center solutions with Freshdesk, Sales Force Automation with Freshsales and IT Service Management Tools with Freshservice. In addition, FreshWorks also provides SMBs for businesses in the fields of healthcare, finance, tourism, media and entertainment, manufacturing, education, IT, telecommunications...

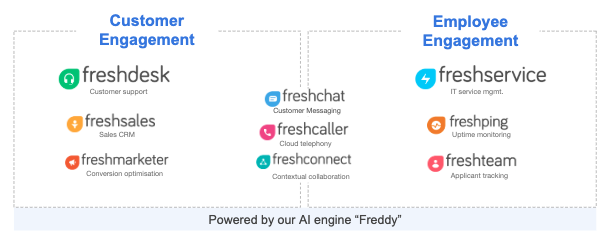

FreshWorks products

1. Customer Engagement Solutions

- Freshchat: Modern online chat software integrated into web or mobile application. Provide customers and employees with a modern messaging service experience. Enable proactive messages based on visitor behavior, send real-time feedback and get all the information context to provide better support service. More specifically, Freshchat can also integrate with CRM tools to manage Leads and orders easily.

- Freshdesk: Intuitive, feature-rich customer care support software. Use Freshdesk to manage all conversations with customers from omnichannel omnichannel at a single place (from Email, Hotline, Live chat, Social Network (Facebook, Twiter), website application, ...), help business does not miss any request. Based on the Cloud Computing platform, Freshdesk provides a variety of features such as ticket management, customer behavior analysis, frequently asked questions (FAQs) setup, automated notification delivery and many other support. other aid.

2. Employee Engagement Solutions

- Freshservice: Bringing a miniature IT Service Desk service to businesses. Management software in the enterprise is easy to use, easy to configure, typically: ticket management, asset management, inventory, contracts, data, catalog functions to help employees easily Select the necessary service during the working process.

- Freshteam: Ideal management software for Human Resources department. A software that supports the human resources department in recruitment, personnel management, holidays, employee data and other work items of the department.

3. Sales & Marketing Solutions

- Freshsales: Support the sales team to manage and approach customers. Provide a CRM platform that fully meets the necessary features for sales activities, such as automating connections with phone and email, tracking customer behavior, scoring leads and managing customer transactions. other transactions.

- Freshmarketer: Increase the conversion rate of users on the web. The All-in-one Conversion Rate Optimization Toolkit is packed with all the powerful features you need to increase customer conversions for your website and sales funnel.

Due to the explosion and development of AI, Freddy AI Bots has facilitated business operations to become smoother, increase customer experience as well as predict and analyze interactions for businesses.

FreshWorks Commitment

Product Commitment

|

|

Fast and flexible |

Popular design |

Platform Commitment

|

|

|

High security about ISO, SOC II, GDPR, HIPAA… with storage system located in US, EU, ANZ, IND. |

Customize configurations for each industry with more than 500 built-in APIs.

Customize configurations for each industry with more than 500 built-in APIs.