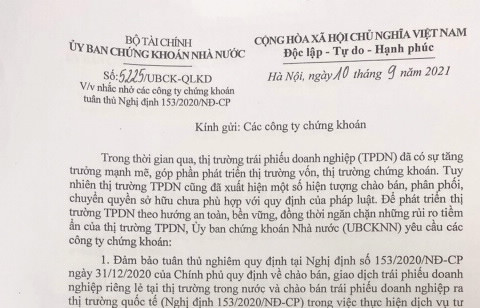

The State Securities Commission has sent an official dispatch to securities companies reminding them of the compliance with Decree 153/2020/ND-CP regulating the offering and trading of individual corporate bonds in the domestic market and the offering of corporate bonds to international market.

The State Securities Commission said that the corporate bond market has had a strong growth, contributing to the development of the capital market and the stock market. However, in the corporate bond market, there have been offering, distributing, and transferring ownership that are not in accordance with the provisions of the law.

Therefore, in order to develop the corporate bond market in a safe and sustainable direction, and at the same time prevent potential risks of this market, the State Securities Commission requires securities companies to strictly comply with the provisions of Decree 153/2020/ND-CP dated December 31, 2020 of the Government, regulating the offering and trading of individual corporate bonds in the domestic market and the offering of corporate bonds to international market in providing consulting services on bond offering documents; professional securities investor identification service; bidding services, guarantee, bond issuance agency; bond registration, depository and transfer services.

At the same time, securities companies must strictly comply with regulations on reporting regimes in Circular 122/2020/TT-BTC and reporting regimes as prescribed in Decree 153/2020/ND-CP.

The State Securities Commission said it will organize inspection of the service provision of securities companies related to corporate bonds and strictly handle violations in accordance with the law.

Before that, at the beginning of September 2021, Minister of Finance Ho Duc Phoc had Document No. 10059/BTC-VP sent to the State Securities Commission; The Banking and Finance Department and the Vietnam Stock Exchange requested to strengthen the inspection and supervision of the corporate bond market. In particular, the Minister assigned the State Securities Commission to assume the prime responsibility for, and coordinate with the Finance and Banking Department and relevant agencies in strengthening and speeding up the inspection, examination and supervision of the issuance and supply of securities. providing services on individual corporate bonds, especially the issuance of small and newly established enterprises, operating in high-risk fields, with unclear business results, matter; focus on reviewing and detecting enterprises showing signs of violating or circumventing the provisions of the law in the issuance of corporate bonds. In case of detecting fraudulent acts, showing signs of appropriating investors' assets, they shall promptly transfer them to the police for handling in accordance with law.