Nguyen Hoang Phan Long

Newsletter No 04.2017

Legal update

Download attached file: Newsletter No 04.2017

AASC honored to receive Top Trade Services Award 2016

On 22 April, 2007, at the International Conference Center (No. 11 Le Hong Phong - Hanoi), the Ministry of Industry and Trade held an awards ceremony for outstanding entrepreneurs and enterprises in the field of trading and services in 2016. AASC Auditing Firm was honored the third time as "Vietnamese Typical Trading Service Enterprise". On behalf of the Company's leaders, Chairman / CEO Ngo Duc Doan received the award, Certificate of Merit and Souvenir Cup from Minister of Industry and Trade Tran Tuan Anh.

The "Vietnam Top Trade Services" award is held every three years to encourage and honor businesses and entrepreneurs in 11 groups of trade and services that Vietnam committed to open its doors entered the World Trade Organization in 2007, including: environmental services, distribution services, financial services, construction services, information services, general business services, travel services , transportation services, health-social services, educational services and cultural services. This year, the title of "Vietnam - WTO 10th Year" marks the 10th anniversary of Vietnam's accession to the World Trade Organization (11/1/2007 - 11/1/2017), coincides with the occasion celebrating 10 years of AASC transformation from SOEs into Limited Liability Company with two or more members (2007-2017).

From over 400 nominations, through 3 rounds of selection, the Organizing Committee decided to award the Vietnam Top Trade Services Award in 2016 to the Top 10 "Excellent Trade Services Entrepreneurs 2016"; Top 10 "Excellent Trade Services Enterprises 2016" and Top 83 "Typical Top Trade Services Enterprises 2016". AASC is proud of being a very successful integrated enterprise of the independent auditing industry awarded by the Ministry of Industry and Trade for many consecutive years.

Newsletter No 02/03 - 2017

Legal update

Download attached file: Newsletter No 02/03.2017

First meeting of the Lunar New Year 2017

Early spring meeting has become an annual nice tradition of AASC Auditing firm each spring. In the morning of 02 February 2017 (The January 6th of the Lunar New Year), general harmony in the air excited by the first working day of the new year 2017, Board of General Directors, leaders of departments and units, auditors, audit assistants, technicians and staff... of AASC Auditing Firm had the meeting on the occasion of the new year.

On behalf of the Board Members and Board of Directors, the Chairman - General Director Ngo Duc Doan was sent to all labor collective of the AASC Auditing Firm the New Year greetings of wellbeing, prosperity, new joys, and new victories. At the same time, he also announced the good news on the same day 8 am; AASC’s General Director signed contracts with traditional client - Viettel Telecom Army. The contract is worth a total of over 7 billion, alarm New Year’s success of AASC and collective employees.

Each individual is excited and eager to get lucky early luck of Leadership and Executive Committee of Trade Union. Board of General Directors, leaders of departments and units, auditors, audit assistants, technicians and staff... of AASC Auditing Firm toast the New Year in the common house. We will open a new spring, a new year 2017 with the determination to uphold the spirit of collective solidarity, consensus. The company’s Board of Directors is confident that this will help to maintain the strength AASC position helps maintain the leading position, while always reminding individuals improve themselves to welcome the successes, accomplishments of the following decade.

Photos at the meeting:

BBT

Newsletter No 01.2017

Legal update

Download attached file: Newsletter No 01.2017

Railway sector asked to develop sustainably in 2017

HÀ NỘI – Deputy Minister of Transport Nguyễn Ngọc Đông urged the Vietnam Railway Corporation (VNR) to enhance transport quality and use technology in management for sustainable development in 2017.

During a conference on VNR’s production and business plan in 2017 on Thursday, the deputy minister underlined efforts the railway sector made in 2016 to maintain growth.

According to Đoàn Duy Hoạch, VNR deputy director general, the company’s output and revenue hit VNĐ7.97 trillion (US$350.9 million), and VNĐ8.34 trillion, respectively, equivalent to 87.7 per cent and 88.8 per cent of the figures in 2015. The company earned post-tax profit of VNĐ137 billion.

Hoach attributed the fall in output and revenue to the reduction of its joint stock companies and networking due to divestment and equitisation.

The collapse of the Ghềnh Bridge in Đồng Nai, storms and floods in the central region, uncompetitive transport price, and newly-restructured subsidiaries also explained the corporation’s poor performance, Hoạch said.

To improve the sector’s competitiveness and efficiency in 2017, VNR aims to submit a proposal to the ministry to enhance the performance of the railway network nationwide, with focus on the Hà Nội-Vinh route.

VNR will also mobilize social resources, investing in means of transport and support facilities.

Additionally, the corporation will accelerate the implementation of key projects, particularly related to infrastructure and train building.

Efforts will also be made to better business management and reform administrative procedures. — VNS

Source: Viet Nam News

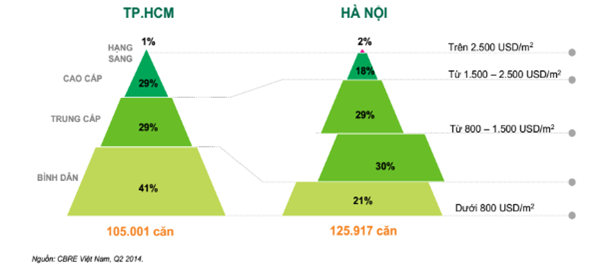

Strong resurgence of luxury real estate in Ho Chi Minh City

After a long absence, the luxury real estate projects in the Ho Chi Minh City recognized signs of prosperity. However, as identified by some investors at the Congress III of Ho Chi Minh City real estate Association (HoREA), luxury and above housing segment will hardly achieve good liquidity levels after more than a year having successful business.

According to Mr. Le Hoang Chau, Chairman of HoREA, in 2016, real estate inventory still has about 31.842 billion, 19.047 billion decrease compared to 2015. In which, Ho Chi Minh City inventory has 5.954 billion left, down 4.153 billion. Real estate market continues to recover, though not as strong as in 2015, but some segments still show attraction.

Operating results of the HCM City real estate market in 2016 showed that the average class housing which occupies 79,7% remains the leading segment. In terms of prices, in 2016, the apartment price rose approximately 5%, land sales prices increased higher, approximately 10%, depending on the type of product, utilities, or location.

In 2017, the real estate is forecasted to be still in the growth phrase, but the increasing can be slower than in 2016. Forecasts to 2020, the market will be adjusted to address the supply-demand mismatch currently tends to shift towards the premium segment (including real estate in terms of tourism and resort)

As reported by CBRE Vietnam, from the second quarter of 2016, the market saw buying back of luxury real estate with primary asking price from $ 3,500 / m2 (80 million/m2) or higher.

Trading activities of this segment has been quiet since 2014, has had a bit lively in QIII / 2015 and now there are signs of more robust with supply from Vinhomes Golden River (about 1,000 apartments of the Aqua), D'.Palais de Louis (242 apartments), the combination Madison (187 apartments), Waterfront Saigon (33 apartments), Lavenue Crown (200 apartments), The One (420 apartments), The Nassim Thao Dien (238 apartments) ... The majority of these projects are located in the favorable district 1.

Ms. Duong Thuy Dung - Director of Market Survey Department of CBRE Vietnam predicts that in 2017, the luxurious apartments will account for about 3% of the total supply. This ratio in 2016 was 1%.

Accordingly, in the next year, separate segment of average class housing in Ho Chi Minh City will receive about 10,000 apartments. Meanwhile, the segment of luxury apartments exceed double, most projects are located in the downtown district and the East. Typically, thousands of apartments in the project The Empire City are located in Thu Thiem, or more than 200ha of Novaland project in Thanh My Loi and 100ha of Him Lam Land at the former golf course in District 2 and of course, we cannot fail to mention urban areas of Dai Quang Minh Sala also with more than 100 hectares in the heart of Thu Thiem.

That's not to mention nearly 5,000 apartments in Saigon Peninsula project with an investment of over $ 6 billion and 4 other super luxury projects of Truong My Lan will debut in 2017 in the South.

Because many projects in this segment have huge area, so the supply from the East is very diverse in terms of price. Is probably the most expensive area of Thu Thiem at around USD4,000 - USD6,000 / m2. A little further is the Hanoi Highway, Mai Chi Tho, Dong Van Cong price falls between USD2,500-USD3,000/ m2.

Vo Van Huu Phuoc - Director, Head of Valuation and Research Vietnam Cushman & Wakefield, said that in 2017, the luxury segment with the growth, but high-end real estate groups have sizable supply. This could lead to oversupply by purchasing power and affects the luxury segment in the future. Mr. Phuoc also said that in 2017, the intermediate segment and affordable housing will still lead the market.

Gia Khang

Source: Tri thuc tre

Extension of trade agreements about rice between Vietnam - Philippines

The Government has issued Resolution renew trade agreement between the Government of Vietnam and the Government of the Philippines in the form of exchange of diplomatic notes.

Specifically, the Government agreed to extend the agreement between the Government of Vietnam and the Government of Philippines concerning Vietnam’s providing rice to the Philippines in the form of notes exchange and approved the content of the exchange of diplomatic notes.

The government authorized the Ministry of Foreign Affairs in collaboration with the Ministry of Industry and Trade to complete and to send a note to Philippines to renew the Agreement mentioned above and implementing external procedures involved.

Source: Vietnam Customs News

Industry told to rely less on fleeting strengths

His comments came at a 2016 review meeting held in Hà Nội yesterday, during which he praised the Ministry of Industry and Trade (MoIT) for its successes in restructuring via reducing the number of units and staff while improving its effectiveness.

“It has stumbled, but not fallen. It has shown strong improvement,” he said at a conference yesterday.

The PM said that while the ministry removed several superfluous administrative procedures to resolve difficulties faced by people and businesses, it experienced limitations including decreasing output and crude oil prices, exerting pressure on the State budget.

Many projects had been tardy and suffered prolonged losses. Some planning strategies had not been effective, and failed to create the needed momentum to attract investment from the private sector, including into industries and sectors like automobile, mechanics, steel and electricity.

The PM said the market watch and trade border management agencies had also not been fully effective against smuggling and multi-level marketing activities. In addition, the restructuring of State-owned enterprises had been slow.

Some issues relating to the hiring of staff had dented the Ministry’s image, he noted.

“The Ministry should strive to develop the country’s industrial sector by reducing dependence on unsustainable advantages and natural resources such as crude oil, coal and minerals. The sector should base itself on science and technology and creativity to generate its development momentum,” he said.

He asked the ministry to formulate specific policies for development of key industrial products like automobiles, electronics and mechanics.

It should also develop industry to serve hi-tech agriculture, he added.

He also asked the ministry to build a national brand for key Vietnamese products.

The PM urged the industrial sector to quickly and actively integrate with and exploit ASEAN and China markets. The country should take advantage of trade pacts, improving market management and reducing counterfeit goods.

The mechanisms for e-commerce development and border trade should strive to break new ground, he said.

“The issue is also how to better exploit the local market with a population of around 100 million. The ministry should encourage Vietnamese people to use Vietnamese goods of high quality and reasonable prices,” he said.

Four targets set

Industry and Trade Minister Trần Tuấn Anh said the ministry had set four targets to help the country’s gross domestic product (GDP) grow by 6.7 per cent in 2017: increase industrial production index by 8-9 per cent; exports by more than 6-7 per cent; keep trade deficit to under 3.5 per cent of export revenues; and increase retail goods sales and service revenues by 10-11 per cent.

The ministry would step up restructuring of the industrial sector by stepping up development of processing and manufacturing sectors while reducing outwork and assembly of industrial products, he said.

Apart from removing a number of complicated administrative procedures, the ministry would strive to create the best conditions for enterprises to develop, the minister said.

He also said the ministry would take full advantage of free trade agreements (FTA) to actively support domestic enterprises participate in global supply chains.

It would also put forth policies to provide more assistance for support industries, while working with the involved parties to simplify customs procedures and supply businesses with useful information to prevent and handle trade disputes, he affirmed.

Anh proposed that the PM approves a particular mechanism to implement urgent power projects, a plan to restructure businesses under the Electricity of Việt Nam Group (EVN) in the 2016-20 periods, and a strategic scheme to develop the power sector through 2025 with a vision towards 2040.

He also recommended that the Government approves a framework for average retail electricity prices between 2017 and 2018, and a decision to increase the EVN’s chartered capital.

The Minister asked the government to direct the Ministry of Finance to support the Việt Nam National Oil and Gas Group (PetroVietnam) in implementing the government guaranteed undertaking (GGU) commitments on preferential tariffs for the Nghi Sơn Refinery and Petrochemical Complex for 10 years of commercial operations.

He also suggested the government consider ways to support the oil and gas, coal, and fertilizer sectors and amend Decree No 203/2013/NĐ-CP on calculating and collecting money from minerals mining. — VNS

Source: Vietnam News

AASC successfully held training class on audit of settlement project

From 12 January to 14 January 2017, in jubilantly atmosphere of the New Year 2017, AASC Auditing Firm successfully held training class on audit of settlement project organized and cooperated by Department of Quality control and Training, Department of Settlement for Investment, Project Department, R&D Division and Business Support Unit.

Speaking at the training class, Chairman/General Director Mr. Ngo Duc Doan stressed the importance of the audit of settlement project for over 25 years and development strategy of AASC up to 2027, vision to 2037. The training program is carefully prepared with the aim of continuously improving the service quality, in accordance with Vietnamese auditing standards No. 1000 - audit of settlement project report under Circular No. 67/2015/TT-BTC dated 08 May 2015 and Circular No. 09/2016/TT-BTC on 18 January 2016 of the Ministry of Finance. After the presentation of an audit report, audit records, paper work, professional ethics, Deputy General Director Pham Thanh Giang and Deputy General Director Pham Anh Tuan delivered a section to help auditor, auditor assistant clearly understand the requirements of standard bidding proposal as well as Bixtrix24 software to manage and archive the audit records in an efficient manner. Participants also have the opportunity of discussing, sharing professional knowledge and experiences with others, which reflect strong and tight relationship between each and every AASC’s members.

At end of the program, Deputy General Director Nguyen Thanh Tung assigned and believed that the auditors, technicians will improve their professional knowledge, and ethic, therefore audit of settlement project of AASC will continue to grow, confirming the leading role among Vietnam Auditing companies.

Images at the training class:

Viettel becomes fourth telecom provider in Myanmar

Myanmar National Tele & Communications Co., Ltd (MNTC), a joint venture between Viettel Global, Myanmar National Telecom Holding Public Limited (MNTH) and Star High Public Company Limited (Star High) on Thursday officially received a licence to begin offering nationwide telecommunications services under the Mytel brand name.

The company has received a licence to operate for 15 years in Myanmar, its tenth market. It targeted to launch the telecom services within 12 months of receiving its licence and will cover 95 per cent of Myanmar’s market within three years.

Myanmar is Viettel’s largest foreign market, as its population is around 60 million.

“Our vision is to have a better network than other current providers when we launch our network. We will build a modern and wide telecom network across Myanmar quickly,” said Le Dang Dung, Viettel’s deputy general director.

Myanmar has been part of the strategy for Viettel’s market expansion, especially in developing Asian countries.

After 10 years of operation, Viettel has been listed among the Top 30 largest telecom companies in the world. Most of its foreign markets report profits and are listed among the largest companies in those countries.

Viettel will continue its sustainable and long-term investment strategy by considering telecommunication as a national infrastructure. This has been a factor in being successful in Viettel’s expansion.

Vietnamese telecom major Viettel holds a 49 per cent stake in the joint venture, while the local consortium of Star High and MNTH own 28 per cent and 23 per cent, respectively.

The fourth telecom operator is expected to invest an estimated capital of US$2 billion in the country over a five-year period and cover 95 per cent of the population in three years. With this project, Viet Nam takes the 7th position among the largest foreign investors, and second largest investor in ASEAN in Myanmar. — VNS

Source: ICT news

AASC'S transparancy report updated december 2017

Attachment: Transparency Report updated January 2018

10 milestones in 2016

1. Successfully organize the Ceremony of 25th anniversary of AASC (13/5/1991-13/5/2016)

The Ceremony of 25th anniversary of AASC named “AASC – 25 years with Pride and Aspiration” has been numerous of customers, national and international enterprises, to attend, recognized and highly appreciated. A quarter of the century has passed; AASC today is not only the results of 25 years with pride but also the aspirations of the coming years, and contribute to the strength of Vietnam Audit.

2. HLB International Conference of the Asia - Pacific region to achieve good results

“Transnational investment - Challenges and Prospects” is the topic of LHB Conference 2016. The conference was the opportunity for Member States to exchange, to learn from each other's experience, to connect efficiently and to aim the business development. Besides, the conference recorded AASC’s role in the progress of International LHB and Vietnam Audit.

3. Appointment of Deputy General Directors and key leaders

This is the company‘s honor and proud when the Deputy General Director Vu Xuan Bien and the Deputy General Director Pham Anh Tuan, the persons with bright and professional ethics in the contribution to the company were appointed. In parallel, in order to strengthen the human resource to carry out AASC’s development strategy in nowadays competitive situation, The General Director has appointed Mr. Ngo Minh Quy to be the Director of Ho Chi Minh Branch. Besides, at the 10th Congress of Board of Members, the Board has approved the appointment of Mrs. Nguyen Thi Thanh Tu as the company Chief Accountant since 1st December 2016.

4. AASC coordinates with prestigious partners to organize diverse seminars

With the special subject of tax policy and accounting applied in enterprises, and of cloud computing technology in the activities of enterprise management; via the seminars, AASC answered the enterprise’s problems in the practical application of the new policy. At the same time, the company has promoted the communication and contributed to spread the image of AASC.

5. Achieve high rank according to data from Ministry of Finance and VACPA

According to the data publish at the Conference of Audit Company Leaders in 2016, AASC has rated 5th rank by total revenue (right after Big 4), 1st rank by number of audit practitioners, 1st rank by revenue from valuation service, 1st rank by Audit of Project settlement report revenue. The first ranks by numerous activities criteria mark the important achievement and responsibility of AASC in the contribution to the strength of Vietnam Audit.

6. Successfully held the Conference of 9 years of implementation the services of Audit of project settlement report

Since the date of conversion of AASC into the limited liability company with two or more members, after 9 years of implementation the services of Audit of project settlement report (2007-2016), in consecutive years, AASC achieved 1st rank in the revenue of Audit of project settlement report, according to data from Ministry of Finance and VACPA, contributing to maintain his position on Audit of project settlement report in Vietnam independent audit.

7. Opening of AASC office in Ho Chi Minh City

With a total area of 600m2 used for the purposes of management, administration and business, AASC is the only audit company holding the offices in both Ha Noi and Ho Chi Minh City. This event helped raise AASC’s brand and position for audit activities and consulting activities.

8. Development of experts’ team holding international certificate

In the year of 2016, AASC strengthen the training of auditors and auditor assistants towards the goal of building a professional staff team with good moral qualities, professional expertise, with the purpose of internationalize the certificates. In the 10th financial year, two members of AASC have been certified CPA, ACCA and CIMA.

9. Promote cooperation with the audit firm in the industry

In the last financial year, AASC promoted cooperation with the auditing company in the sector to implement a number of services as the audit of project settlement report, the audit of financial statement, and the enterprise valuation. Promoting cooperation contributes to increase the revenue and the quality of services provided by AASC in particular and by audit firms in the industry in general.

10. The 10th Congress of Board of Members successfully organized

The 10th Congress of Board of Members has been successfully organized: The band of Audit firm AASC with historical mission, with the “oldest brother” position of the firms in the industry, and the traditional value were elevated in the Resolution of the Congress, and recorded as provisions of the policy, and as an inseparable part of AASC Company’s culture.

Congratulations on 25th anniversary of School of Accounting - Auditing

On 20 November 2016, on the occasion of 25 years of the establishment of School of Accounting - Auditing - National Economics University and appreciation of Vietnamese Teacher’s Day, on behalf of Board of General Directors of AASC Auditing Firm, Ms. Cat Thi Ha – Deputy General Director of AASC aka. an alumnus of K37 Audit class honorably attended and awarded gifts to School of Accounting – Auditing - National Economics University.

During 25 years of development, School of Accounting – Auditing is one of the leading educational institutions in Vietnam in the field of accounting and auditing as well as a long-term and sustainable partner of AASC Auditing Firm – the leader among Vietnamese Auditing Firms. At the same age and together passing through difficulties, challenges and affirming the leading position, it is not by chance that School of Accounting – Auditing - National Economics University and AASC Auditing Firm can gain such proud achievements. Our two organizations regularly have had mutual support activities. School of Accounting – Auditing is a reliable training body, providing AASC Auditing Firm with qualified and skilled employees. Meanwhile, AASC Auditing Firm provides students of School of Accounting – Auditing with internship opportunities in the professional working environment.

At the ceremony, Ms. Cat Thi Ha, along with friends and teachers, reviewed the old good memories of student lives with dream and ambition. She also expressed her gratitude and congratulations to teachers who have made enormous contributions to high-quality human resources for Vietnam Auditing Industry so that AASC Auditing Firm can have highly qualified staff to bring clients with best quality services and great confidence.

Happy Vietnamese Teacher’s Day. Hopefully, two organizations will continue to accompany and well corporate with each other on the way to success in the next 25 years, 50 years and forever after.

Image of ceremony:

_BBT_

Meeting on summarizing 9 years of conducting audit of settlement projects

On 20 November 2016, at the headquarter, AASC Auditing Firm has organized a meeting on summarizing 9 years of conducting audit of settlement projects since the AASC‘s transformation from SOE (2007-2016). The meeting’s attendees include General Director Mr. Ngo Duc Doan, Deputy General Director Mr. Nguyen Thanh Tung, Deputy General Director Mr. Bui van Thao, Deputy General Director Mrs. Pham Thanh Giang and leaders; auditors come from investment-settlement audit department, project audit department, and AASC’s branch in Ho Chi Minh City and in Quang Ninh province.

After the speech of units, Deputy General Director Mrs. Pham Thanh Giang delivered the report on summarizing 9 years of conducting audit of settlement projects since the AASC‘s transformation from SOE to Limited Liability Company with 2 or more members. AASC has maintained its leading role among Vietnam Auditing companies for many years and achieved the highest revenue from audit of settlement projects. At end of the meeting, General Director Mr. Ngo Duc Doan praised the efforts of the whole staffs and stressed that AASC need to continue improving service quality, opening more training courses, and assisting other auditing firms in an effective manner in order to contribute more to the development of Independent Audit sector.

Some images of the meeting:

BBT

The 10th board of member's meeting successfully Held

On 22 November 2016, at its headquarter, AASC Auditing Firm has organized the 10th Board of Member’s meeting with the appearance of members and 02 distinguished guests: Senior Manager of Foreign Investment Service Department 2 and Audit Department 6 in a jubilant atmosphere to celebrate its achievements during 09 years since AASC’s transformation from SOE (2007 – 2016), and maintain the TOP5 position in Vietnam Independent Auditing.

The Tenth Meeting was marked with number of highlights: Revenue increased by over 10% compared with the financial year VIII, audit services of the Company increased by 7.24%, in which audit services of project settlement rose by 17.64% compared to the previous financial year; the consulting service has witnessed a significant increase by 81.57%. The Member of Management Board of the Company has discussed thoroughly about setting targets, direction, and action plan of AASC auditing firm for the 10th fiscal year. With the appointment of two new Deputy General Directors, one Director at AASC’s branch, one Senior Manager, AASC believes in the 10th fiscal year, the Company will achieve more success and towards the successful implementation of the development strategy of AASC.

At end of the meeting, Chairman of the Board of Member, General Director of AASC Auditing Firm, Mr. Ngo Duc Doan has praised for the efforts of the Board of Members, especially he showed his grateful for the significant contribution of Member of Board of Member - Deputy General Director Mr. Nguyen Quoc Dung, also Mr. Ngo Duc Doan called for wholehearted contribution of all members for AASC’s development in the following years. The Chairman also believed that with the right strategy and the consensus of all members, Board of General Directors, auditors, managers and staff, AASC Auditing Firm will develop strongly and stably, confirming its leading role among Vietnamese auditing companies.

Images at the Meeting:

BBT

Growing up under difficulties

On behalf of Audit Department No. 7, Senior Manager Mr. Nguyen Ngoc Lan has reported results of the Department in the fiscal year IX, as well as advantages, opportunities, obstacles and challenges. In the fiscal year VIII, revenue of Audit Department No. 7 rose by 33%, ranking No.2. On this occasion, Senior Manager Nguyen Ngoc Lan showed his gratitude to General Director, Board of Directors in supporting Audit Department No. 7 to accomplish the assigned tasks and praised the efforts of all members of Audit Department No. 7 in contribution to the sustainable development of AASC.

Speaking at the Meeting, Chairman of the Board of Member – General Director of AASC, Mr. Ngo Duc Doan complimented Audit Department No. 7 on its excellent performance in the fiscal year IX. He also set target, directions for the Department in the next fiscal year and inspired people with AASC’s development.

The meeting was ended with number of repertoires, putting a highlight for the successful of the 9th fiscal year. Four years have passed and marked with efforts and proud achievements of Audit Department No. 7. For the upcoming years, the Audit Department No. 7 will commit to contribute more to the AASC’s growth.

Images at the Meeting:

BBT

AASC celebrated 86-year anniversary of Vietnamese Women's Day (20/10/1930 - 20/10/2016)

On the occasion of Vietnamese Women's Day 20/10, at AASC’s headquarter, Trade Union and Youth Union of AASC Auditing Firm jubilantly organized a meeting to congratulate female staff, auditors, technicians as well as marked 86-year anniversary of the establishment of the Vietnam Women's Union (20/10/1930 – 20/10/2016). Attendees at the ceremony include representatives of the Board of General Director, Trade Union and Youth Union, representatives of the departments, units, and branches together with female staffs, auditors and employees of the company.

Speaking at the ceremony, Head of Trade Union – Ms. Cat Thi Ha, on behalf of the Trade Union and female staff, expressed the special thanks to the Chairman, Board of Directors and male staff for their deeply caring. Also, she wishes the female staffs and their family health, happiness, good work and constantly striving for strong growth of AASC.

On behalf of Member Board and Board of General Director of AASC, Chairman and General Director – Mr. Ngo Duc Doan sent his regards to female auditors, officers and staffs and gave credits to their significant contribution in the development of the AASC as well as in Independent Auditor sector and wishes them beauty, health, happiness, successful completion of all assigned tasks.

Special repertoires performed by Youth Union of AASC made a great end to the meeting. It closed in the joyful and warm atmosphere.

Photos of the meeting:

BBT

AASC appointed 2 new deputy general directors

At the ceremony, the Chairman of Board of Members - General Director Mr. Ngo Duc Doan praised the contributions of the members of the Member Board including newly appointed leaders in the development of AASC today. This is the pride of AASC to have strong and professional leaders, which is an important element for the implementation of long-term plans and development strategy of the AASC in the context of current fierce competition with Big 4 and other companies. Additionally, General Director Ngo Duc Doan encouraged newly appointed leaders to accomplish the assigned tasks with strong spirit together with all leaders and staffs of the Company to maintain AASC’s leading position among Vietnamese Auditing Firms.

On behalf of newly appointed key leaders, Mr. Vu Xuan Bien expressed sincere thanks to leaders of AASC for being supportive and entrusting them to excellently complete all assigned tasks, together with the leaders and staff of AASC to strengthen and expand the image of the AASC locally as well as globally.

Photos of the ceremony:

BBT

Chairman of the Board of Members – General Director of AASC was honored as one of the 100 outstanding Vietnamese Businesspeople 2016

On the occasion of Vietnamese Entrepreneurs’ Day (13 October), in the evening of 11 October 2016, at Friendship Cultural Place (Hanoi), Board of Emulation and Commendation together with Vietnam Chamber of Commerce and Industry (VCCI) organised a launching ceremony of patriotic emulation program “Vietnamese Businesspeople to integrate and develop” and award ceremony to outstanding Vietnamese Businesspeople 2016 that have made an remarkable achievements to business activities, and humanitarian activities.

Prime Minister Nguyen Xuan Phuc launched the ceremony of patriotic emulation program and with Vice President of Vietnam Dang Thi Ngoc Thinh, Chairman of the Central Committee of the Vietnamese Fatherland Front Nguyen Thien Nhan, President Vietnam Chamber of Commerce and Industry (VCCI) Vu Tien Loc awarded Saint Giong Trophy to outstanding business people 2016.

At the ceremony, Mr. Ngo Duc Doan, Chairman of Board of Members – General Director of AASC Auditing Firm Company Limited was honored to be the one of 100 outstanding Vietnamese Business people to receive Saint Giong Trophy in 2016 for his relentless efforts, and creative thinking. He has led AASC with the Board of Directors for over 25 years of operation, achieved success and achievements, strengthening the firm’s strong growth in the current context of deeper global economic integration and confirming the leading role among Vietnamese audit firms. He received prestigious ‘Outstanding Vietnamese Businesspeople 2016’ title in recognition of his remarkable contributions to the Vietnamese Independent Audit in general and to AASC in particular. This is the pride and joy of all AASC staffs.

Photos at the Ceremony

Prime Minister Nguyen Xuan Phuc launched the ceremony of patriotic emulation program

Mr. Ngo Duc Doan, Chairman of Board of Members – General Director of AASC Auditing Firm Company Limited received Saint Giong Trophy in 2016

Director of Department of Emulation and Commendation – Ministry of Finance congrats

BBT

Conference "Network safety security solutions and Cloud computing"

In recent years, the application of cloud computing technology has created a new trend in governance activities and is now considered as the key to the success of many businesses. Catching up the trend, on 30 September 2016, AASC Auditing firm - One of the top accounting, auditing, tax consultants and management consulting businesses in Vietnam, also a trustworthy partner providing information technology (IT) solutions and business management of Microsoft, in collaboration with Department of information and Communications of Quang Ninh province and Microsoft Vietnam organized a Conference "Network safety security solutions and Cloud computing for agencies and enterprises in Quang Ninh province. The conference was held successfully with the participation of representatives from more than 20 Departments and leaders of many enterprises in Quang Ninh province. Representative of AASC participated in the Conference included: Ms. Pham Thi Thanh Giang - Deputy General Director in charge of Business Consulting, Mr. Pham Anh Tuan - Head of IT department, IT application consultant and Ms. Nguyen Thi Thanh Ha – Tax Consultant.

At the Conference, delegates analyzed the current situation of IT development, especially issues regarding optimizing the cost of investment and application of information technology, preventing the risk of confidential problems, impact of policy changes on the selection of technology application. Therefore, many solutions and direction for IT development of businesses are introduced and discussed regarding cloud computing platform. In addition, experts participating in the Conference also provided an update of tax policies applicable from 01 July 2016. The Conference ended with excitement, theoretical and practical situation. The Conference is considered as an important step for the long-term cooperation between AASC and other units, agencies, and businesses in Quang Ninh province. At the end of the Conference, many believe that effective combination between AASC‘s deep understanding on the enterprise management and Microsoft on technology applications regarding cloud computing platform will certainly bring optimal solutions to meet the needs of businesses in the new era.

Some pictures of the Conference:

Tax measures to solve difficulties for enterprises

The Government Office has announced the Conclusion of Deputy Prime Minister Vuong Dinh Hue at the meeting on draft Resolution about tax measures to solve difficulties, obstacles, boost the enterprise’s development.

The announcement clearly states that the draft Resolution is in line with the policy stipulated in Resolution No. 35/NQ-CP dated 16 May 2016 on supporting and developing enterprises by 2020. Contents of the draft Resolution have been commented by the concerned ministries and agencies and evaluated by the Ministry of Justice. However, there are still many different opinions on the draft Resolution.

In order to promptly complete the draft Resolution and report to the Government at its regular meeting in October 2016, the Deputy Prime Minister requested the Ministry of Finance to promptly complete the draft Resolution in accordance with Resolution No. 35/NQ-CP; To select the urgent contents to be immediately removed and applied in the shortest period, including reports on current issues of the land rent policy applicable to enterprises.

In addition, the Deputy Prime Minister asked the Ministry of Finance to report to the Government on the amendment and supplement to current regulations for long-term implementation.

Proposed solutions applied to small and medium enterprises, including start-up enterprises, information technology enterprises must be consistent with the provisions of the draft Law on supporting small and Medium Enterprises. In cases the Law on supporting small and Medium Enterprises do not prescribe the criteria and tax incentives, the provisions of such contents should be supplemented under the draft Resolution for timely implementation in 2017 and 2018. The Ministry of Finance shall report to the Government to submit to the National Assembly on amendment and supplement to the tax laws for long-term implementation.

There is no provision on offsetting income from real estate transfer with losses from production and business activities when determining income subject to corporate income tax. The Ministry of Finance shall review and evaluate the implementation of the Law on Corporate Income Tax No. 32/2013/QH13, including this issue to propose to the Government for amendment and supplement of the Law if necessary.

The Deputy Prime Minister agrees on the policy of remission of late payment for taxpayers who supply goods and services which are paid by the state budget.

This Resolution does not specify provisions on debt remission, tax freezing, late payment, fines for dissolution, bankruptcy because it is not related to enterprises’ issue. In case of necessity, the provisions shall be regulated in other documents.

The corporate income tax incentives for investment and renovation of old apartment buildings will be 15%, if they are accounted separately and implemented in 2017 and 2018.

The Deputy Prime Minister also asked for a clarification on the impact of the solution to reduce personal income tax to 50% on income from salaries and wages of individuals working in the field of high technology, application of high technology under agriculture sector and processing agricultural products to solve difficulties for businesses. In case of necessity, it shall be applied only to individuals working in the hi-tech sector in small and medium enterprises, sectors and prioritized business lines in 2017 and 2018. In long-term, the Law on Personal Income Tax should be amended and supplemented appropriately.

Source: Ministry of Industry and Trade portal

Mr. Ngo Duc Doan, General Director of AASC: Integration without assimilation

(VIR) When facing with complicated terminology, figures on the financial statements of a business, I often ask for help from experts of AASC Auditing Firm. But the conversation with the CEO of the "made in 100% Vietnam" audit firm recently has brought interesting stories beyond the business issues.

1. 13rd, May 1991 is a memorable day with Mr. Doan and his comrades when they were assigned by Ministry of Finance to work at AASC, one of the first two auditing firms in Vietnam. Looking back at the journey of 25 years of development of AASC, including several years as the leader of AASC, he said: "I have something, my it be destined to work with my comrades here when experiencing many obstacles, they always have faith in me."

He recalled, the time AASC transformed its model from state-owned companies (under the Ministry of Finance) to limited liability Company with two or more members (in 2007) was a difficult period of the company when number of auditors reduced from 118 auditors to only 36.

He said during that period, the stock market and banking sector boomed, attracting many auditors to quit their job or establish new auditing firm. Whereas old members were aware of that the company was facing with lot of challenges and tried to acquire the company.

In order to deal with this matter, he and other leaders aimed to quickly stabilize the company’s operations. In the first two years, AASC generated low revenue, but retained customers, strengthen the confidence of the personnel of the company. In 2009, AASC fell to No. 6 on the audit market, but in 2010, the Company has reached the 5th place after Big4 and maintained its position until now.

In celebration of 20 anniversary of AASC’s establishment from 5 years ago, former Auditor General, Deputy Prime Minister Vuong Dinh Hue stressed that: "AASC maintained the leading position among Vietnamese auditing firms". Indeed, AASC always proud to be the No. 1 audit company in Vietnamese auditing companies, pure Vietnamese auditing company, Integration without assimilation.

Mr. Doan shared his thoughts of what made him most proud of 25 years of driving AASC, which was not the revenue or market share but the cohesion between members, people was together in difficult time and “That was a huge success ".

The consistency and cohesion are expressed among members of the Board of Members and within the company. They, together, made the right decisions to lead the company and auditors when they perform the tasks throughout the country to overcome temptation.

Members of the Board of Members of AASC currently have 31 members including 16 female members. Audit is a difficult job when it requires auditors to check the figures on financial statements and ensure the compliance with standards and regulations. Besides, not only the long business trip throughout the country, especially in peak season, they must release audit reports to meet the deadline of clients. For women, the challenges seem to be more, because they not only accomplish the assigned task for the company but also they have to take care of their families.

2. Vietnam audit sector was opened freely for foreign audit companies, 5 big audit companies entered the market since 1990. Mr. Doan said, AASC has been integrated since its transformation and learned from Big 6, Big 5 and Big 4 audit companies. Auditors of AASC not only have deep knowledge of regulations, standards in Vietnam as well as the way Vietnamese enterprises doing business in Vietnam, but also they catch up with international standards.

Leader of Hoang Huy Group, an enterprise has business with America groups with high demand of financial statements’ quality, said that, they have satisfied with the quality of their financial statements in 2014, 2015, 2016 which were audited by AASC.

From January 2011, AASC joined HLB International - A world-wide network of independent accounting firms and business advisers in over 130 countries with more than 1.900 partners, 14.000 staffs and 500 offices, AASC could offer their clients the international service standards that match with AASC’s global strategy.

AASC currently has its presence in Laos, Cambodia, Thailand, and Indonesia such as audit of the highway project in Thailand funded by WB's capital; participate in the audit report of the ASEAN secretariat, audit of the offshore investment projects of Vietnam Rubber Group, Vietnam National Chemical Group, Party Central Office, etc.

But, he had aware that AASC’s development has been through a lot of obstacles. Vietnam market are competing fiercely, including some tricks such as lower price, "having relationship" with the intermediate, getting customers from other firms, etc.

Even Ministry of Finance issued requirements on price frame for audit of project settlement report but there are proposals offer lower price compare to the hurdle requirements. Big companies accept losses in order to gain customers in other fields; other small and medium companies have to lower the price to gain the market share.

The competition has gone too far along with consequences. Mr. Doan recommended with Big 4 companies, cooperated and helped small and medium companies in order to strengthen the Vietnam audit sector.

3. Business is the life of every entrepreneur. Mr. Doan has experienced a lot of challenges by participating in the assessment of many major economic cases, which the boundary between the compliance with the law and actual situation is extremely fragile. He had involved in legal affairs in 1988, persistent struggled, defended the right, held the prestige of the company and he was appointed by the Ministry of finance to higher position in the following year. It’s clearly to see that, the field of auditing, evaluation may contain potential risk as other jobs.

This year, AASC has entered the age of 25 and the old captain said that in the next 10 years, AASC’s objectives are maintaining the pure Vietnamese auditing firm brand name, where domestic and foreign customers, management agencies, public investment do believe in.

The most desire of an experienced auditor, sticking with the market from its early days, is the Vietnamese auditing company will firmly stand and grow in integration as well as establish long-lasting brand name. But he wonders whether Vietnamese auditing companies have enough resources and faith to build such long-lasting brand name. The old captain has been prepared and trained for the next generation. The 10th meetings of the Board of Members in November will deal with this issue and development of AASC in the future.

Source: Anh Viet - http://tinnhanhchungkhoan.vn/

Precious home

“I drank, probably not much, but enough for me to wildly deep into emotions of family where I started”

Precious Home - one of the annual events held by the leaders, the Trade Union and the Youth Union of Audit Department No. 7.

The program took place on 25, 26 June 2016, at Khoang Xanh – a famous tourist area near the center of Hanoi. A number of activities were organized such as water polo; crossing the river... to reflect strong teamwork spirit. Also, members of Audit Department No.7 experienced best moments together under the program which is combined by sound, lighting and art.

Speaking at the event, Mr. Nguyen Ngoc Lan – Senior Manager of Audit Department No.7 said he was pleased that members of the Department spent two days together and showed his proud for the results that the Audit Department No.7 have achieved during the year. He also hoped that this special occasion would bring enthusiasm to each member of Audit Department No.7 to move forward, together.

The event was undertaken with exciting repertoires, especially was the theatrical performance by the new comers of the Department.

“Khoang Xanh, a sleepless night with fine temperature, some people were gathering around the fire and some at the stilt house. Tonight, we - members of Audit Department No.7 all lied down together, and it seems flush away my worries and nervous in the past few days.

I drank, probably not much, but enough for me to wildly deep into emotions of family where I started”.

Khoang Xanh, 23h44’ pm, 25 June 2016

These are the feelings of the new comer of Audit Department No.7.

Cross-border Investment – Challenges and prospects

From 27 July to 31 July 2016, AASC Auditing Firm Company Limited organized the 2016 HLB International Asia Pacific Regional Conference at JW Marriott Hotel Hanoi. The Conference “Cross-border Investment – Challenges and prospects” was graced by more than 20 members from 19 countries in the region. Honored guest Dr. Vo Tri Thanh, Senior expert, Former Deputy Director of Central Institute for Economic Management attended and delivered speech at the Conference with 2 topics “Regional Economic Overview” and “Doing business in Vietnam and its connection to Asia Pacific”.

At the Conference, Deputy General Director Mr. Do Manh Cuong highlighted: "HLB International Conference 2016 is a special occasion for member countries to learn from one another’s experiences, expand the networking and work towards the common goal of HLB network development”. Besides, Chief Executive Officer of HLB International Mr. Robert Gerard Tautges has commented on the investment prospects in Vietnam and said that Vietnam is an important country and the prospects of international investment into Vietnam were endless Furthermore, Mr. Rob has appreciated AASC for its role in the development of HLB International and for the contributions to the growth of Vietnam’s Independent Audit as well as diversified services currently provided to FDI enterprises in the process of expansion and development of business activities in Vietnam.

The 2016 HLB International Asia Pacific Regional Conference ended with success, leaving HLB members with a deep impression of Vietnam in general and of AASC in particular. HLB regional conferences are a great opportunity for HLB professionals to network together and get to know each other personally, contributing to the development of economic, thus allowing for the smooth running of clients’ business across borders.

Photos of the conference:

BBT

Việt Nam tiếp tục hấp dẫn nhà đầu tư nước ngoài, nhưng...

Hội nghị HLB Quốc tế khu vực châu Á – Thái Bình Dương ngày đầu tiên 28/7

(ĐTCK) Trong con mắt của nhiều nhà đầu tư nước ngoài, Việt Nam là một quốc gia tiềm năng và quan trọng.

Đó là chia sẻ của ông Robert Gerard Tautges, Tổng giám đốc HLB International tại Hội nghị với chủ đề “Đầu tư xuyên quốc gia: Thách thức và triển vọng” diễn ra từ ngày 28 - 30/7.

Hội nghị đã thu hút đại diện của hơn 20 hãng thành viên thuộc tổ chức HLB quốc tế đến từ 19 quốc gia khu vực châu Á - Thái Bình Dương. Tại Hội nghị, các đại biểu đã chia sẻ quan điểm rằng, Việt Nam tiếp tục hấp dẫn các nhà đầu tư nước ngoài, nhưng sẽ phải cạnh tranh khốc liệt hơn trong khu vực.

Thảo luận về tình hình kinh tế thế giới 5 năm qua, thông tin nổi bật mà các đại biểu chia sẻ là tăng trưởng kinh tế thế giới hồi phục khó khăn hơn dự kiến.

Cụ thể, số liệu của Tổ chức Tài chính quốc tế (IMF) cho thấy, năm 2010, tăng tưởng kinh tế thế giới đạt 5,2%; từ 2011-2015 lần lượt là 3,9%; 3,2%; 3,4% và 3,1%. Triển vọng kinh tế năm 2016-2017 là yếu và không ổn định, điều này thể hiện qua việc các tổ chức quốc tế liên tục thay đổi dự báo và đưa các các con số bất định.

Những thách thức nổi lên chủ yếu do suy giảm ở các nền kinh tế mới nổi như Trung Quốc, Ấn Độ, tăng trưởng kinh tế thế giới hiện đang dưới tiềm năng. Những hệ quả của việc các nước thúc đẩy kinh tế chủ yếu do chính sách đổ tiền, can thiệp thẳng vào thị trường mà không chú trọng đến cải thiện hạ tầng, hoạt động và năng lực của các tổ chức tài chính.

TS. Võ Trí Thành, Viện phó Viện Nghiên cứu Quản lý kinh tế Trung ương cho biết, triển vọng của kinh tế thế giới đang phải đối mặt với nhiều rủi ro cao, khiến các nhà đầu tư và người tiêu dùng đều thận trọng. Những cú sốc về giá dầu và các loại hàng hóa khác chưa có dấu hiệu qua đi. Đặc biệt cần lưu ý là Mỹ, châu Âu và Trung Quốc đang tiến hành thắt chặt tiền tệ. Điều này sẽ ảnh hưởng tới chính sách tiền tệ của các nước, đồng thời quan ngại về tác động của Brexit tới kinh tế toàn cầu.

Xu hướng đầu tư trên thế giới cũng sẽ chịu ảnh hưởng của các yếu tố như sự cân bằng giữa các ngành kinh tế tạo ra sản phẩm thực và ngành phi vật chất, sự hội nhập của các nền kinh tế, đòi hỏi về sáng tạo và đặc biệt là phát triển bền vững.

Các nhà đầu tư và doanh nghiệp cũng cần lưu ý đến tác động, ảnh hưởng lên GDP của Asean ++ FTA - RCEP (xem bảng), ảnh hưởng của TPP, EVFTA và RCEP (xem bảng)

Nhận định về triển vọng đầu tư giữa các nước trong khu vực và Việt Nam, ông Robert Gerard Tautges, Tổng giám đốc HLB International cho rằng, không có giới hạn. Trong con mắt của nhiều nhà đầu tư nước ngoài, Việt Nam là một quốc gia tiềm năng và quan trọng. Việt Nam sở hữu nguồn tài nguyên thiên nhiên dồi dào, phong phú và rất nhiều tiềm năng khác mà các quốc gia đang tìm kiếm.

Ông Terry Blenkipsop, đại diện cho nhà đầu tư đến từ Australia chia sẻ rằng, ông đến với Hội nghị và Việt Nam lần này nhằm tìm hiểu những ưu đãi mà Việt Nam dành cho các khách hàng, là những nhà đầu tư nước ngoài mà họ đang cung cấp dịch vụ.

“Chúng tôi thường xuyên được nghe các thông tin về thị trường Việt Nam. Những điều này rất thu hút đối với khách hàng của chúng tôi trong việc tìm kiếm những cơ hội phát triển kinh doanh. Những tiềm năng mà chúng tôi nhìn thấy ở Việt Nam, đó là một trong những quốc gia phát triển nhanh nhất của khu vực”, ông Terry nhận xét.

Giải đáp lý do các nhà đầu tư quan tâm đến Việt Nam thời điểm này, ông Võ Trí Thành cho biết, đó là tư duy cải cách đang khá mạnh mẽ, với kỳ vọng ở các nhà lãnh đạo mới, hệ thống giáo dục được quan tâm chú trọng hơn, môi trường đầu tư kinh doanh dần được cải thiện mạnh mẽ. Song thách thức cạnh tranh với Việt Nam còn rất lớn, vì nhìn vào ASEAN +3 gồm Thailand, Malaysia và Singapore, vẫn có thể thấy những vấn đề mà Việt Nam phải cải thiện, nhằm giảm thiểu chi phí khi nhà đầu tư xin giấy phép hay một số cải cách còn khá chậm chạp khác.”

Bà Winnie Wong, đến từ Canada cũng nhắc đến những vấn đề còn gây bất lợi của Việt Nam như cơ sở hạ tầng chưa đồng bộ, thiếu hụt nguồn nhân lực chất lượng cao như tại vị trí như tổng giám đốc hay quản lý cấp trung…

HLB Quốc tế là mạng lưới quốc tế các hãng kiểm toán và tư vấn quản trị chuyên nghiệp, với khoảng 21.000 nhân viên thuộc 600 văn phòng tại hơn 130 quốc gia trên thế giới. Hội nghị HLB Quốc tế khu vực châu Á – Thái Bình Dương là hội nghị thường niên do mạng lưới HLB quốc tế chủ trì. Năm 2016, Hãng kiểm toán AASC đăng cai tổ chức sự kiện.

Theo đánh giá của ông Robert Gerard Tautges, Tổng giám đốc HLB International, AASC là một hãng thành viên lý tưởng mà HLB tìm kiếm, với vị thế là một hãng kiểm toán uy tín, có trách nhiệm để hỗ trợ khách hàng thiết lập việc kinh doanh tại Việt Nam, giúp giải đáp nhiều vấn đề về thuế, thủ tục hành chính…

Nguồn: tinnhanhchungkhoan

Connecting hearts – connecting happiness

On July 19, at the Ministry of Finance in response to the campaign “Voluntary Blood Donor Day” with the theme “Connecting hearts, connecting happiness” by Youth Union of Ministry of Finance in collaboration with Trade Union of Ministry of Finance, National Institute of Hematology and Blood Transfusion, AASC Youth Union volunteered with the highest spirit. Derived from the heart and the responsibility to the community, every drop of blood donated contributed significantly to medical care and survival of patients (helped save many lives every year).

With the slogan of the Voluntary Blood Donor Day 2016: “New blood – for you and for me”, every member of AASC participated in the campaign has highlighted the traditional solidarity “The good leaves protect the worn-out leaves” of ASSC staff in particular and Vietnamese people in general. Moreover, many AASC members has donated for many times, showing the great spirit of humanity, solidarity, spreading the image and responsibility of AASC not only in Auditing, Accounting and Consulting field, but also raising the awareness of the community.

Photos of Voluntary Blood Donor Day:

BBT

Registration to participate in a Free Conference on “Tax and Accounting in Application for 2016”

To continue supporting FDI companies to master new tax accounting policies applied since 2016, AASC Limited in cooperation with the CPA Australia Hanoi Office is organizing the Free Conference on "Tax and Accounting in Application for 2016" for foreign invested companies in Hai Phong City.

The Conference will be provided by Mrs. Nguyen Thi Cuc – President of the Vietnam Tax Consultants’ Association (VTCA)– Former Vice Director of the General Department of Taxation and Mr. Do Manh Cuong – Member of the Standing Committee of the VTCA – Partner of AASC Ltd who have mass experience in law making, training and interacting with FDI companies. Therefore, the requirements of newly issued regulations on tax and accounting from 2016 will be delivered by the comprehensive manner through illustrative examples, especially the Q&A session, toward the useful benefits for accountants in FDI entities.

Registration

Time: From 13:00 to 17:30 PM on 15 July 2016

Location: LEVEL Hotel Hai Phong 71 Lach Tray Street, Ngo Quyen District, Hai Phong City

Language: Vietnamese

Registration deadline is 14 July 2016 via https://goo.gl/TqRbjM

(Note: Time and duration of the Conference may be changed toward the actual demand of the participants)

Conference Program and Speaker Bio can be found here

All detailed information, please contact the representative of the Organizing Committee:

Mrs. Nguyen Hoang Lan - Business Development Manager of FDI segment – AASC Ltd.

0912 000 472 | This email address is being protected from spambots. You need JavaScript enabled to view it.

Jubilantly celebrated 25th anniversary of Vietnam’s Independent Auditing (1991-2016)

After 25 years of building and development, Vietnam’s Independent Auditing has contributed significantly to the development of the country, emphasizing the key role in the market economy, ensuring the transparency of financial information, creating a healthy investment climate.

Recognizing the contribution and outstanding achievements of AASC in developing the Vietnam’s Independent Auditing in 2011 to 2016, the Prime Minister awarded the Certificate of Merit to the Company for its efforts and AASC’s Chairman of the Board of Member, General Director Mr.Ngo Duc Doan.

At the conference, the Minister of Finance also awarded 03 certificates of Merit to individuals, whose outstanding achievements has contributed to the development of the Vietnam’s Independent Auditing in 2011 - 2016: Deputy General Director Pham Thi Thanh Giang, Head of Quality Control and Training Department Do Ngoc Dung and Auditor Tran Thu Loan.

Being aware of the great responsibility for the development of the Vietnam’s Independent Auditing, AASC Board of Directors and all its employees commit to act continuously as a leading role in Vietnam’s Independent Auditing field, strongly integrated with the International, keeping pace with other countries in the region and the world.

Photos of the Conference:

Deputy General Director Cat Thi Ha AASC received Certification of Merit from the Prime Minister on behalf of AASC

Deputy General Director Do Manh Cuong received Certification of Merit on behalf of General Director Ngo Duc Doan.

Deputy General Director Pham Thi Thanh Giang, Head of Quality Control and Training Department Do Ngoc Dung and Auditor Tran Thu Loan received Certificates of Merit from the Minister of Finance

Musical performance performed by the Youth Union of AASC

BBT

Hello Summer 2016 - Vinpearl Halong

Following the sequence of events celebrating the 25th anniversary of the establishment of AASC Auditing Firm, and welcome the International Children's Day (1st June) for 3 days from 29 May to 31 May 2016, all officers, staffs of AASC had gathered together at Vinpearl Halong participating in “Hello Summer 2016” program with the theme “AASC - 25 years of aspiration and proud”. The event took place with many attractive group activities, in order to enhance the adherence between divisions/ units of AASC.

On behalf of the Board of directors, at Gala Dinner, Deputy General Director Nguyen Quoc Dung highly appreciated the efforts of the Board of Directors, auditors, technicians and staffs of AASC in the past few years and sent his best regards to their family members, who are always stand behind and help them to accomplish the tasks. Besides, on the occasion of International Children’s Day, Mr. Dung also wishes the children healthy, obedient and enjoys the happiness moment with family and friends at Vinpearl Halong 2016.

Team building activities took place on the morning of 30 May 2016 in the vibrant atmosphere, reflecting the spirit, culture of AASC on white sand shore. It seems like the sunshine, charming wind of Halong has supported AASC’s outdoor activities more exciting. With exciting games such as pushing the trolley car, walked and hit the ball with duels on muscle strength from four teams has brought the excitement and laughter crisp for everyone. Finally, with highest score the winning prize belongs to “1102” team. Through the meaningful games at this special occasion, AASC’s staffs and officers are closer to each other.

In the afternoon of 30 May 2016, the football matches were held with the appearance of four teams coming from the Departments/Units/Branches of AASC. The winner is Audit Department No. 5 Fc.

“HELLO SUMMER 2016” has remained in each AASC member with happiness, deep memories, and add strength to all member of AASC to overcome difficulty, prepare for the new journey. This special event also creates value for AASC, strengthen the working environment of openness, sincerity, and promote each individual willing to contribute to our precious AASC.

Images at Halong

Deputy General Director Nguyen Quoc Dung at the Gala dinner

The champion - 1102 team

Hello summer - Vinpearl Ha Long

BBT

Kiểm toán độc lập Việt Nam: 25 năm đồng hành cùng Đổi Mới

Một trong hai công ty kiểm toán đầu tiên trên thị trường, Hãng Kiểm toán AASC, kỷ niệm 25 năm thành lập

Ra đời trong bối cảnh đất nước đổi mới, thị trường kiểm toán độc lập Việt Nam đã phát triển song hành cùng sự phát triển của nền kinh tế, của TTCK và trở thành điểm tựa niềm tin của thị trường.

1. Năm 1991, thị trường dịch vụ kiểm toán được hình thành, với việc thành lập hai công ty kiểm toán đầu tiên trực thuộc Bộ Tài chính là VACO (Deloitte ngày nay) và AASC trước đòi hỏi của công cuộc đổi mới, thu hút dòng vốn đầu tư nước ngoài.

Qua những bỡ ngỡ ban đầu, thị trường đã hình thành với sự góp mặt của nhiều doanh nghiệp kiểm toán hàng đầu thế giới (Deloitte, KPMG, E&Y, PwC) và bùng nổ từ giai đoạn chuyển đổi doanh nghiệp Nhà nước sang công ty cổ phần và thăng hoa của TTCK.

Ở tuổi thứ 25, theo thống kê của Hội Kiểm toán viên hành nghề Việt Nam, thị trường kiểm toán độc lập hiện có 140 công ty đang hoạt động, trong đó có 6 công ty có vốn đầu tư nước ngoài. Số doanh nghiệp kiểm toán thu hẹp so với giai đoạn bùng nổ thành lập công ty kiểm toán những năm 2007 – 2008, nhưng đó là kết quả của sự thanh lọc để thị trường kiểm toán độc lập phát triển quy củ, nền nếp hơn.

Những công ty kiểm toán quy mô quá nhỏ, hoạt động yếu kém không đáp ứng được yêu cầu ngày càng chặt chẽ về điều kiện cung cấp dịch vụ buộc phải giải thể, một số công ty chọn cách sáp nhập vào một công ty kiểm toán khác để tăng quy mô kiểm toán viên, khách hàng để đáp ứng đủ điều kiện cung cấp dịch vụ kiểm toán cho các công ty đại chúng, niêm yết…

Bên cạnh mảng dịch vụ chính là kiểm toán và soát xét báo cáo tài chính, các dịch vụ kiểm toán và tư vấn khác như kiểm toán quyết toán vốn đầu tư, dịch vụ kế toán, dịch vụ tư vấn thuế, dịch vụ thẩm định giá, dịch vụ tư vấn tài chính… được khối công ty kiểm toán độc lập cung cấp đang đáp ứng nhu cầu ngày càng đa đạng trong nền kinh tế.

Số liệu cập nhật nhất của tổ chức nghề nghiệp kiểm toán cũng cho biết, năm 2014, tổng doanh thu toàn thị trường đạt 4.583 tỷ đồng; trong đó, mảng dịch vụ chính yếu của khối công ty kiểm toán là dịch vụ kiểm toán và soát xét báo cáo tài chính là 2.329,76 tỷ đồng, chiếm khoảng 50% cơ cấu doanh thu toàn ngành.

Với lĩnh vực kiểm toán báo cáo tài chính, kể từ khi Luật Kiểm toán độc lập ra đời, đối tượng bắt buộc phải kiểm toán báo cáo tài chính năm được mở rộng hơn, bao gồm công ty đại chúng, tổ chức phát hành, CTCK, công ty bảo hiểm, ngân hàng, doanh nghiệp FDI, doanh nghiệp nhà nước và doanh nghiệp có trên 20% vốn góp của Nhà nước… không chỉ mở ra cơ hội phát triển cho ngành kiểm toán độc lập, mà đáp ứng yêu cầu mới của nền kinh tế.

Là lĩnh vực hoạt động chuyên môn sâu, đòi hỏi những quy tắc, chuẩn mực nghề nghiệp hết sức chặt chẽ, đến nay, như chia sẻ của PGS. TS. Đặng Thái Hùng, Vụ trưởng Vụ Chế độ kế toán và kiểm toán, Bộ Tài chính, hành lang pháp lý cho hoạt động kiểm toán của Việt Nam đến nay đã tuân thủ các thông lệ, chuẩn mực của quốc tế, gồm Luật Kiểm toán độc lập, nghị định hướng dẫn, hệ thống chuẩn mực kiểm toán và chuẩn mực đạo đức nghề nghiệp.

2. Thị trường kiểm toán Việt Nam đã có bước tiến lớn, nhưng trên con đường song hành cùng sự minh bạch của nền kinh tế, đòi hỏi phải nâng chất hoạt động của khối doanh nghiệp này.

Chất lượng dịch vụ kiểm toán không chỉ ảnh hưởng bởi những kiến thức, kinh nghiệm của người làm kiểm toán, mà còn ảnh hưởng rất lớn của đạo đức kiểm toán viên. Hành lang pháp lý cho hành nghề kiểm toán dù đã hoàn thiện, nhưng để kiểm toán viên đi đúng hành lang đó, khâu quản lý, giám sát chất lượng hàng nghề kiểm toán có vai trò rất quan trọng.

Nếu như trước kia, việc kiểm soát chất lượng kiểm toán được Bộ Tài chính ủy quyền cho Hội Kiểm toán viên hành nghề Việt Nam thực hiện, phía Ủy ban Chứng khoán thực hiện theo cơ chế phối hợp khi cần kiểm tra chất lượng cuộc kiểm toán theo yêu cầu quản lý, thì từ năm 2014, với Quy chế chấp thuận kiểm toán công ty trên TTCK theo Thông tư 183/2013/TT - BTC, việc kiểm soát chất lượng các công ty kiểm toán tổ chức trong lĩnh vực chứng khoán thuộc thẩm quyền của Ủy ban Chứng khoán Nhà nước.

Hàng năm, Bộ Tài chính đều tổ chức các đoàn kiểm tra chất lượng dịch vụ, nhưng việc kiểm tra chỉ thực hiện trên một số công ty và chủ yếu là thực hiện với các công ty có quy mô nhỏ trên thị trường. “Ngay cả việc tổ chức định kỳ ba năm một lần với một doanh nghiệp kiểm toán theo quy định hiện nay cũng là rất khó”, ông Đặng Thái Hùng chia sẻ. Lý do là bộ máy nhân sự của Bộ còn rất mỏng, không thể căng ra quản lý, giám sát khi khối lượng công việc soạn thảo chính sách, chế độ cho lĩnh vực kế toán, kiểm toán quá lớn.

Còn về phía Ủy ban Chứng khoán Nhà nước, được biết, kể từ thời điểm được chuyển giao chức năng kiểm soát chất lượng dịch vụ của khối công ty kiểm toán tổ chức niêm yết, công ty đại chúng, trong năm 2014, cơ quan này đã kiểm tra 5 công ty, năm 2015 kiểm tra 6 công ty và dự kiến trong năm nay sẽ kiểm tra 17 công ty.

Tại các quốc gia phát triển, sau những bê bối tài chính của doanh nghiệp, công ty kiểm toán cũng sẽ bị liên đới điều tra và trong nhiều trường hợp bị xử phạt rất nặng, thậm chí lâm vào vòng lao lý như trong trường hợp Tập đoàn Enron (Mỹ).

Việc nhiều doanh nghiệp bất ngờ thua lỗ, dù chỉ kỳ kế toán trước vẫn báo lãi cao và được kiểm toán chấp nhận là báo cáo “trung thực và hợp lý” như trước kia là Vinashin, DVD hay gần đây là CTCP Y tế Việt Nhật, Tập đoàn Đại Dương và một số ngân hàng 0 đồng… không chỉ khiến thị trường hoang mang về độ tin cậy của các báo cáo kiểm toán, mà còn đặt câu hỏi: Có hay không việc liên đới trách nhiệm của kiểm toán viên?

Vì vậy, việc kiểm soát chất lượng dịch vụ kiểm toán, đặc biệt là kiểm tra các hồ sơ kiểm toán công ty có những chiêu làm đẹp báo cáo tài chính là đòi hỏi từ phía thị trường với cơ quan quản lý.

AASC hold on Free Conference on “Notes on tax finalization for 2015, Practical application of Circular 200/2014/TT-BTC and Tax Update from 2016”

Following the success of the Free Conference on “Guidelines for accounting policies for enterprises under Circular No. 200/2014/TT-BTC” on July 2015, AASC Limited in cooperation with the CPA Australia Hanoi Office is organizing another Free Conference on “Notes on tax finalization for 2015, Practical application of Circular 200/2014/TT-BTC and Tax Update from 2016” targeted the FDI entities in Hanoi and surrounding provinces.

The Conference will be provided by Mrs. Nguyen Thi Cuc – President of the Vietnam Tax Consultants’ Association (VTCA)– Former Vice Director of the General Department of Taxation and Mr. Do Manh Cuong – Member of the Standing Committee of the VTCA – Partner of AASC Ltd who have mass experience in law making, training and interacting with FDI companies. Therefore, the requirements on tax finalization in 2015, practical application of Circular 200 and newly issued regulations on tax from 2016 will be delivered by the comprehensive manner through illustrative examples, especially the Q&A session, toward the useful benefits for accountants in FDI entities.

Registration

Time: From 7:45 to 12:30 AM on 20.5.2016

Location: CPA Australia Hanoi Office

Room 1201A, 12th Floor, Tower A, Handi Resco Building, 521 Kim Ma, Hanoi

Language: Vietnamese

Registration deadline is 19 May 2016 via https://goo.gl/TqRbjM

(Note: Time and duration of the Conference may be changed toward the actual demand of the participants)

Conference Program and Speaker Bio can be found here

All detailed information, please contact the representative of the Organizing Committee:

Mrs. Nguyen Hoang Lan - Business Development Manager of FDI segment – AASC Ltd.

0912 000 472 | This email address is being protected from spambots. You need JavaScript enabled to view it.

The Plant symbol of AASC Auditing Firm Company Limited

In celebration of the 25th anniversary of establishment of AASC Auditing Firm Company Limited and Vietnam’s independent audit, we would like to introduce the plant symbol of AASC.

The plant symbol of AASC is a flowering plant species called Dracaena Fragrans which is a money tree, and fortune plant.

The plant consists of three stems with height of 1m, 50cm and 13cm respectively.

The stem of 13cm in height rises with 2 branches, symbolizing the commencement of the Vietnam’s independent audit along with the establishments of AASC Auditing Firm (AASC) and Vietnam Auditing Company (VACO).

The stem of 50cm in height rises with 6 branches, specifying the period from 2008 to 2010 with 06 biggest Audit firms including AASC.

The stem of 1m in height rises with 5 branches, indicating 5 biggest Audit firms in the market, of which AASC is the only local firm.

The total numbers of the branches equal to 13 which contain special meaning. Particularly, the milestone on 13 May 1991 was marked with the establishment day of AASC Auditing Firm Company Limited and the commencement of the Vietnam’s independent audit.

Images of the Dracaena Fragrans:

BBT

AASC JUBILANTLY CELEBRATED 25 YEARS OF ESTABLISHMENT

Director General of Corporation 36 under the Ministry of National Defense, representative of AASC clients delivered a congratulation speech, Colonel Nguyen Dang Giap

AASC Board of Directors made a 25th Anniversary toast

AASC auditing firm held a Football Championship to mark its 25th anniversary of establishment (13/5/1991-13/5/2016)

Towards the 25th anniversary of the establishment of AASC auditing firm (13/05/1991-13/ 05/2016) and the celebration of 60th anniversary of Department of Accounting and Auditing Regulations (11/10/1956-11/10/2016), on 16/04/2016, AASC auditing firm held a mini football championship which include four teams: the home team AASC auditing firm and 03 other teams Department of Accounting and Auditing Regulations - Ministry of Finance, Department of Finance and Accounting - Viettel Corporation, and Vietnam Steel Corporation. Honored guests invited to cheer on the team: Mr. Dang Thai Hung – Director of Department of Accounting and Auditing Regulations, Mr. Dang Hung Minh - Director of the Department of Department of Emulation and Commendation, Mr. Nghiem Xuan Da – General Director of Vietnam Steel Corporation, and Mr. Vu Duy Huynh - Chief Accountant of Vietnam Steel Corporation along with numerous supporters for the teams.

At the opening ceremony, two matches between the home team and the Department of Accounting and Auditing Regulations team; between Vietnam Steel Corporation and Viettel Corporation team were undertaken under exciting, enthusiasm, and friendship atmosphere. The pace of the game was accelerated at the early minutes; the players played very energetically, tried their best and dedicated to the audience the most beautiful game. However neither team scored, thus they had to compete in the penalty shoot - outs. The team from Department of Accounting and Auditing Regulations excellently won the triumph, the second title belongs to the team from Viettel Corporation, the third prize belongs to the home team AASC auditing firm, and the special prize belongs to Vietnam Steel Corporation for their fairly performance.

This Football Championship was held for the purpose of maintaining and improving the healthy workplace and workforce within the company to better serve the professional work, connect and enhances the friendship between AASC and other precious units that have been stood with AASC throughout its journey during 25 years of building and development.

Images of the Football Championship

BBT

Vietnam achieved commercial agreements with major trading partners in 2015

Implementing Directive No. 15/CT-TTg dated 07 July 2015 of the Prime Minister on the continued implementation of Resolution No. 22/NQ-BCT dated 10 April 2013 of the Political bureau on international integration, Vietnam has actively negotiated and signed new free trade agreements (FTAs) with partners. By the end of 2015, Vietnam has signed 10 bilateral and multilateral FTAs (including the ASEAN Free Trade Area, ASEAN Free Trade Area - China, ASEAN - Korea, ASEAN - Japan, Vietnam - Japan, ASEAN - Australia - New Zealand, ASEAN - India, Vietnam - Chile, Vietnam - Korea and Vietnam - Eurasian Economic Union), finished the negotiation of 2 important agreements with EU and USA, announced the completion of the EU-Vietnam free trade agreement (EVFTA, dated 02 December 2015) and negotiated successfully Trans-Pacific Partnership (TPP, dated 05 October 2015). Besides, 2015 marks the year Vietnam officially joined the ASEAN Economic Community (AEC). Therefore, 2015 is considered as pivotal year in the process of international economic integration of Vietnam with important advances.

Reached agreements with major trading partners

EU-Vietnam free trade agreement

Launched from June 2012, EVFTA went through 14 round of negotiation, lasting from October 2012 to August 2015. After finishing basically negotiation of the contents of the agreement dated 04 August 2015 and dealing with technical issues and finalizing the text of agreements dated 02 December 2015, the two sides announced the completion of the negotiation. Vietnam pledged to eliminate tariffs once the Agreement enters into force with elimination of 48.5% of tariff lines, equivalent to 64.5% of imports from EU, and after 10 years with elimination of 99% of tariff lines, equivalent to 99.8% of imports from EU. For the remaining tariff lines, Vietnam will have a roadmap for over 10 years or provide preferential to the EU on the basis of WTO tariff quotas.

Trans-Pacific Partnership

After 5 years of intense negotiations, TPP agreement between 12 member states officially finished negotiation on 05 October 2015 (expected to be signed in the first quarter of 2016). Vietnam has committed to eliminate tariffs on 66% of tariff lines as soon as TPP takes effect and elimination of 86.5% of tariff lines after 3 years the Agreement came into force. The remaining items will have the schedule on tariff reduction from 4 to 10 years. Some goods are particularly sensitive, Vietnam committed to the roadmap for over 10 years or tariff quota.

ASEAN economic integration

Joining the AEC, Vietnam not only has to implement trade agreements but also commits to open in many other areas. Officially established in late 2015, AEC includes the three main pillars: the Political-Security Community (ASEAN – ASC), the Economic Community (AEC) and the Socio-Cultural Community (ASEAN - ASCC) and is built on four interrelated and mutually-reinforcing pillars: (i) a single market and production base through free flow of goods, free flow of services, free flow of investment, free flow ò capital, free flow of skilled labor, (ii) a highly competitive economic region shaped from competition policy, consumer protection, intellectual property rights, infrastructure development, taxation, e-commerce (iii) a region of equitable economic development implemented through SME development, initiative for ASEAN Integration, and (iv) a region fully integrated into the global economy through coherent approach towards external economic relations, enhanced participation in global supply networks (WTO).